How might the future role and value of Visual Art be transformed in a post-digital world?

Exploring the Digital Art EcoSystem

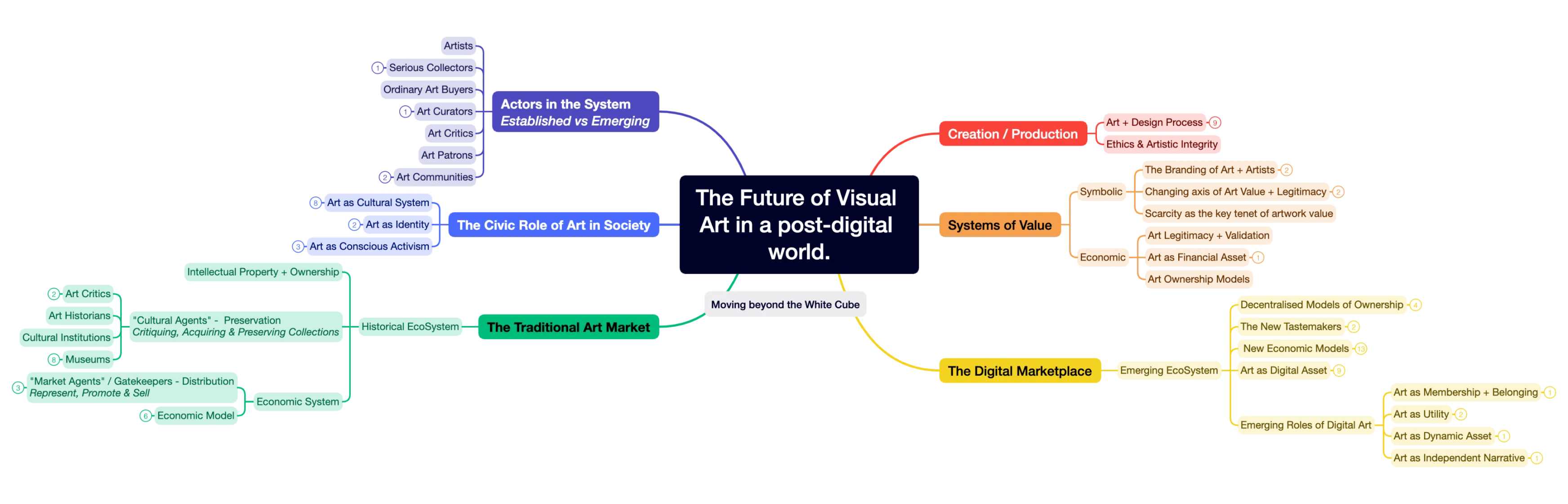

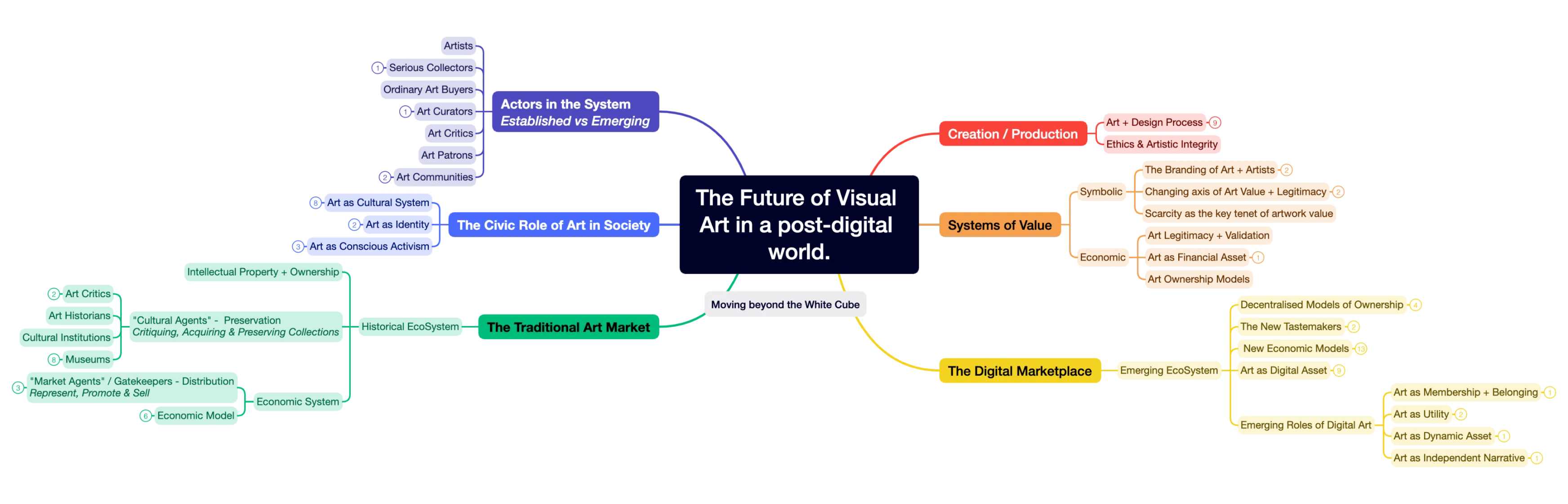

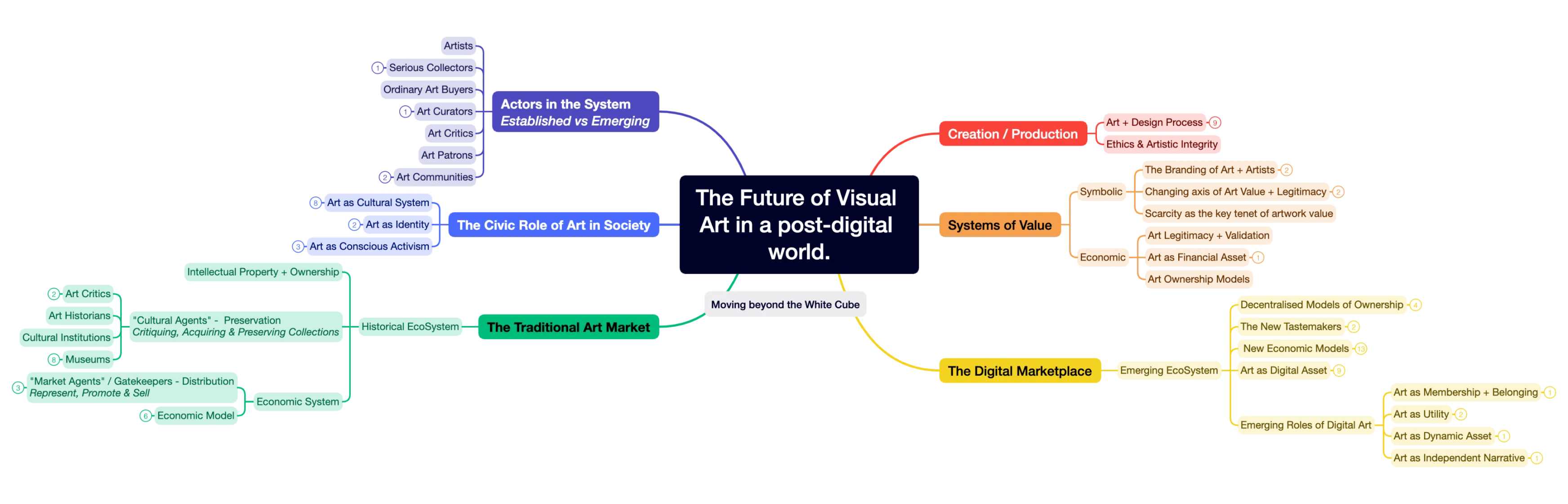

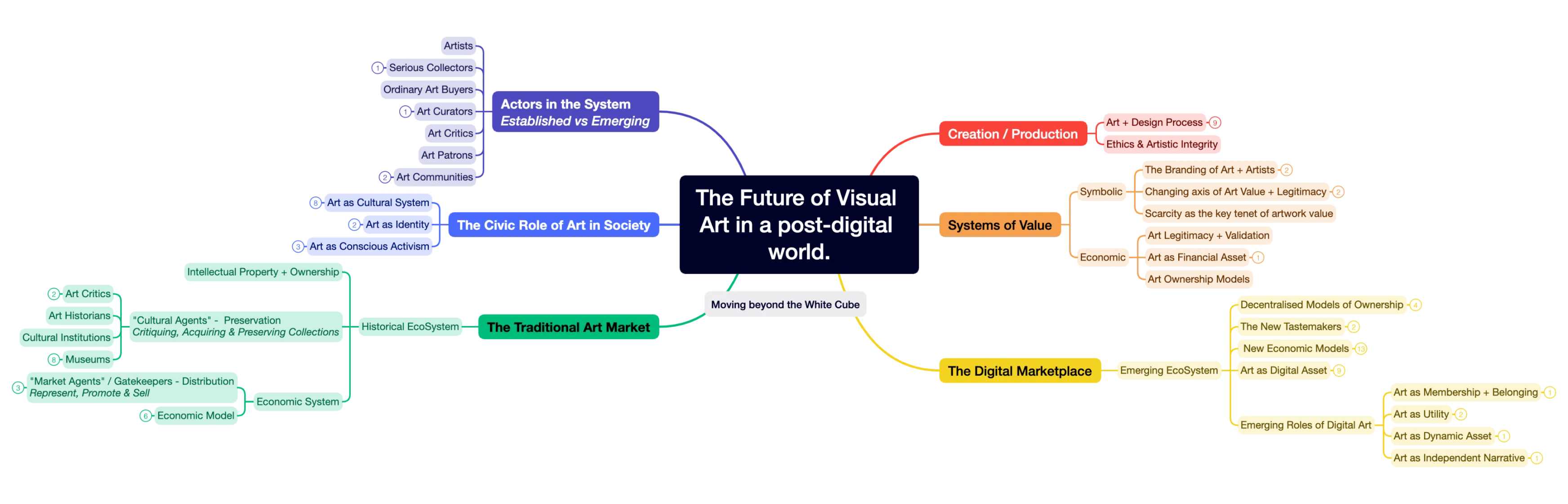

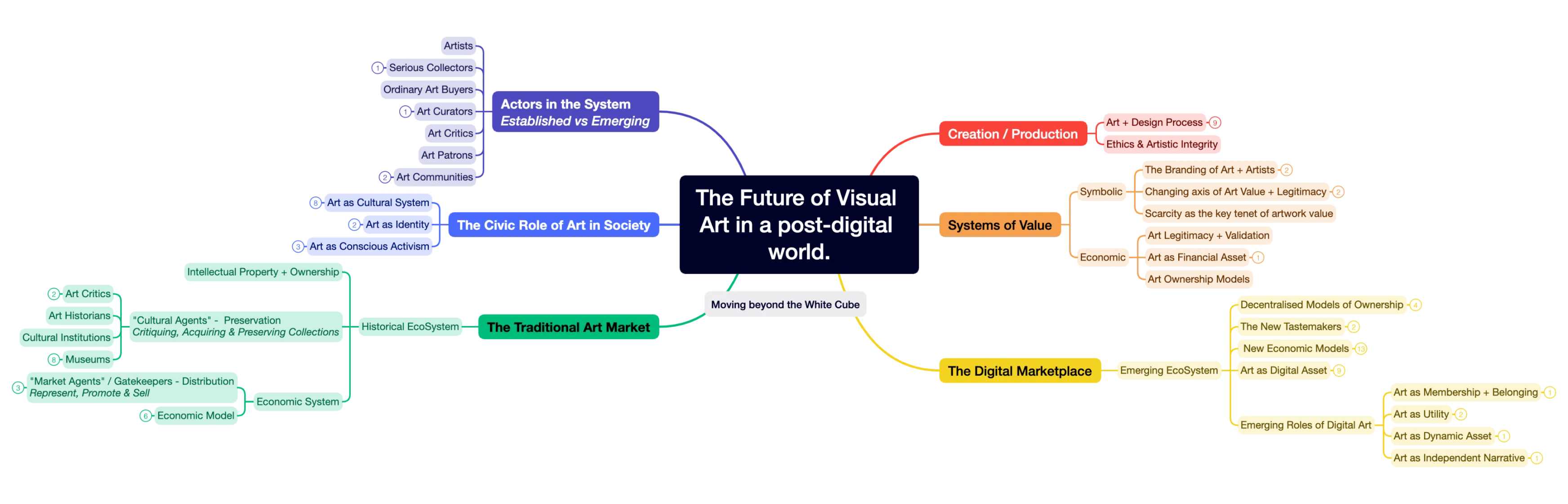

Exploring the Domain + Key Lines of Enquiry

How might we might think more critically about the emerging economic models and systems of value & legitimacy that the Digital Art World invites; and their implications for the future role and value of all Art in the Post-Digital Age?

Defining Post-digital / For the purposes of clarity, I use the term’ post-digital’ to describe the period in which our intense historical fascination with all things digital has passed and we accept digital as being a core part of both society and the systems within it, rather than to describe some disenchantment or withdrawal from it.

How are systems of meaning and value being reshaped in the digital space?

How will the online merging of selling & critiquing shape our future ideas of the legitimacy of art?

How will the cultural context that is specific to the internet, change the way we think about collectable Art?

How are advancements in technology and digital platforms reshaping the role of the artist, enabling new forms of creative expression and expanding artistic boundaries?

If all art processes occur within a social and cultural context, how might the digital art space refocus the idea of art-making and production as a collective process?

How might this impact the systems operating within the art world?

In what ways might we see the systemic issues operating within the Arts economy, as representative of the broader economy in general?

There’s no question that NFTs will ever replace physical art completely, but they will disrupt the physical visual art industry and the systems within which it operates, in some way.It’s also interesting to consider the traditional Art Industry as an economic system representative of the broader economy; upon which the same power dynamics, economic structures and distribution models assign value, restrict access, cultivate inequity and amplify the widening gap between value creation and value extraction.

The Economics of Art

Those who completely dismiss digital art have much to lose and as long as artists perceive scarcity and physicality as the only route to true legitimacy and value, they will be forever beholden to these systemic structures of inequality.So when we explore visual art in the post-digital age; we are exploring the realm of the artist and the impact of digital technology but more importantly, we are exploring the shifting dynamics in both the domain (culture) and the field (society) at large — and how this challenges historical structures of wealth, power, value and legitimacy.

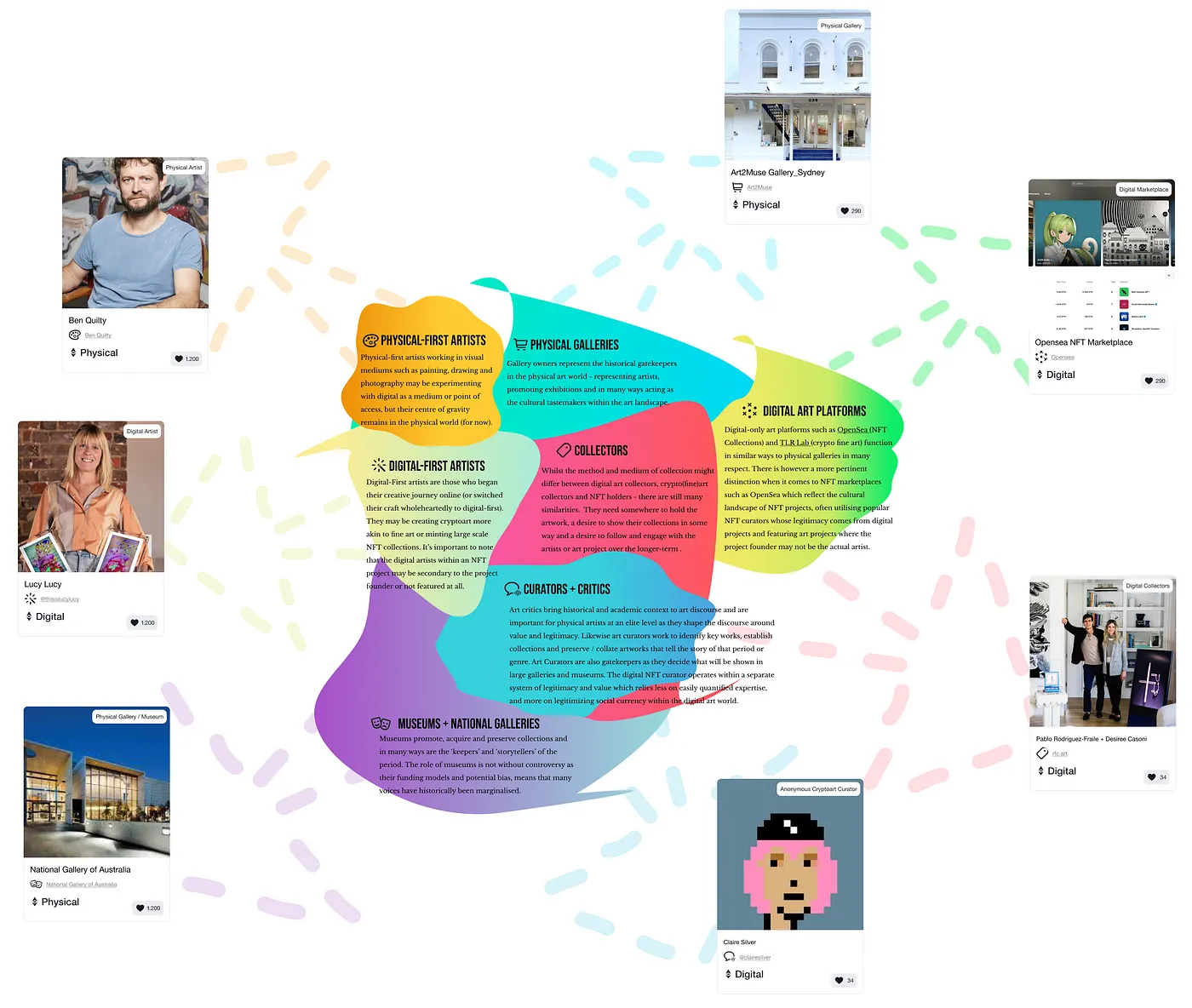

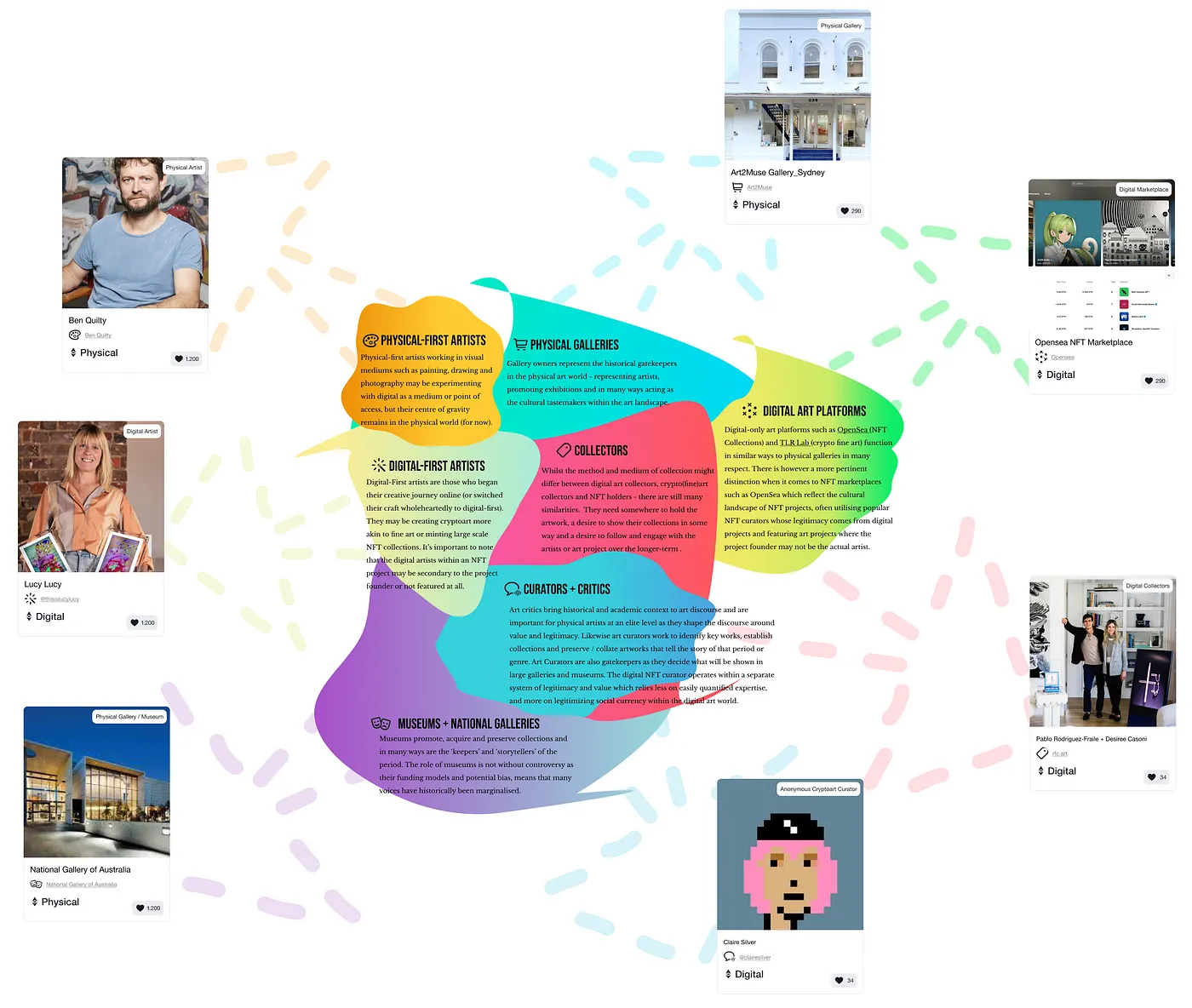

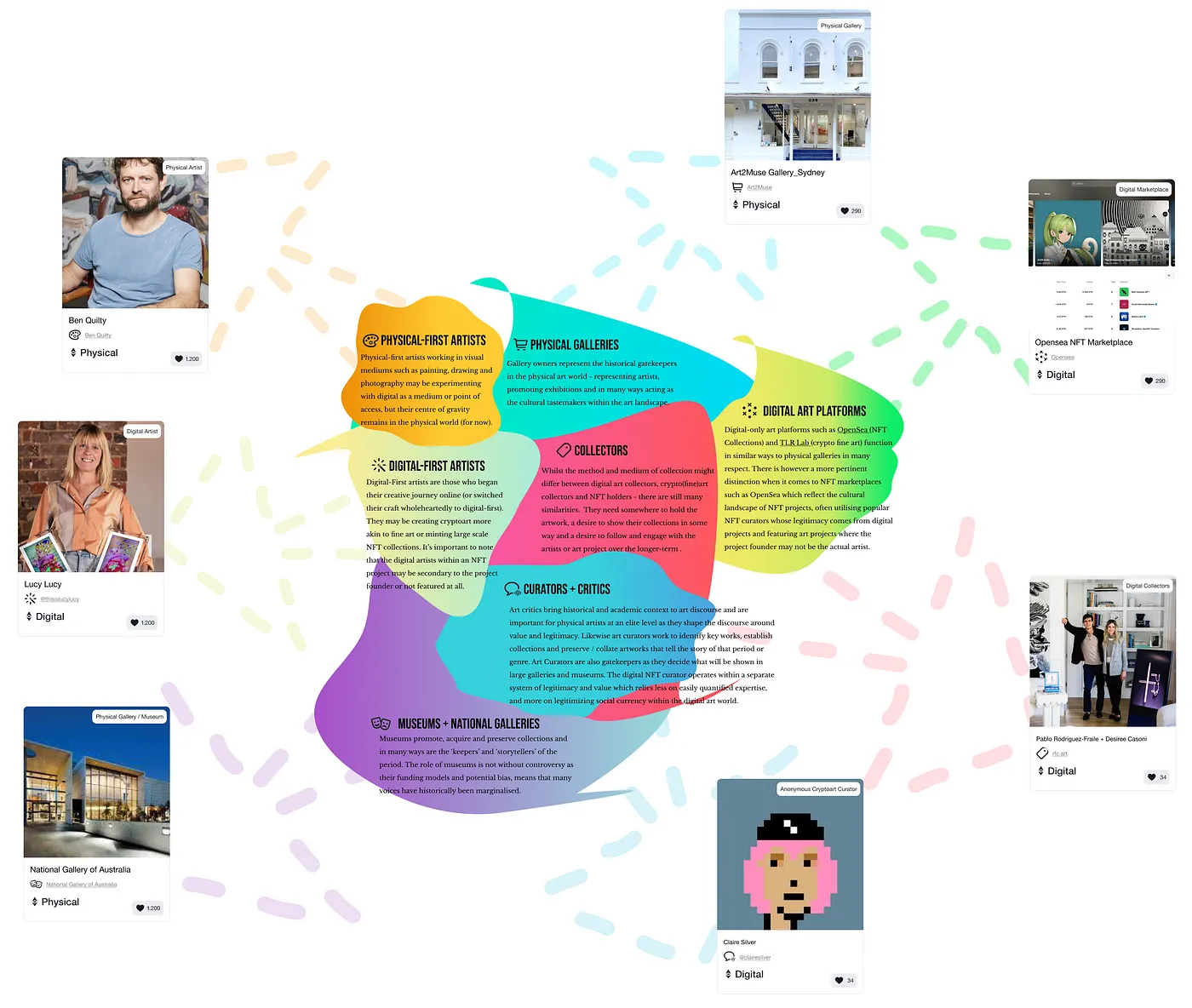

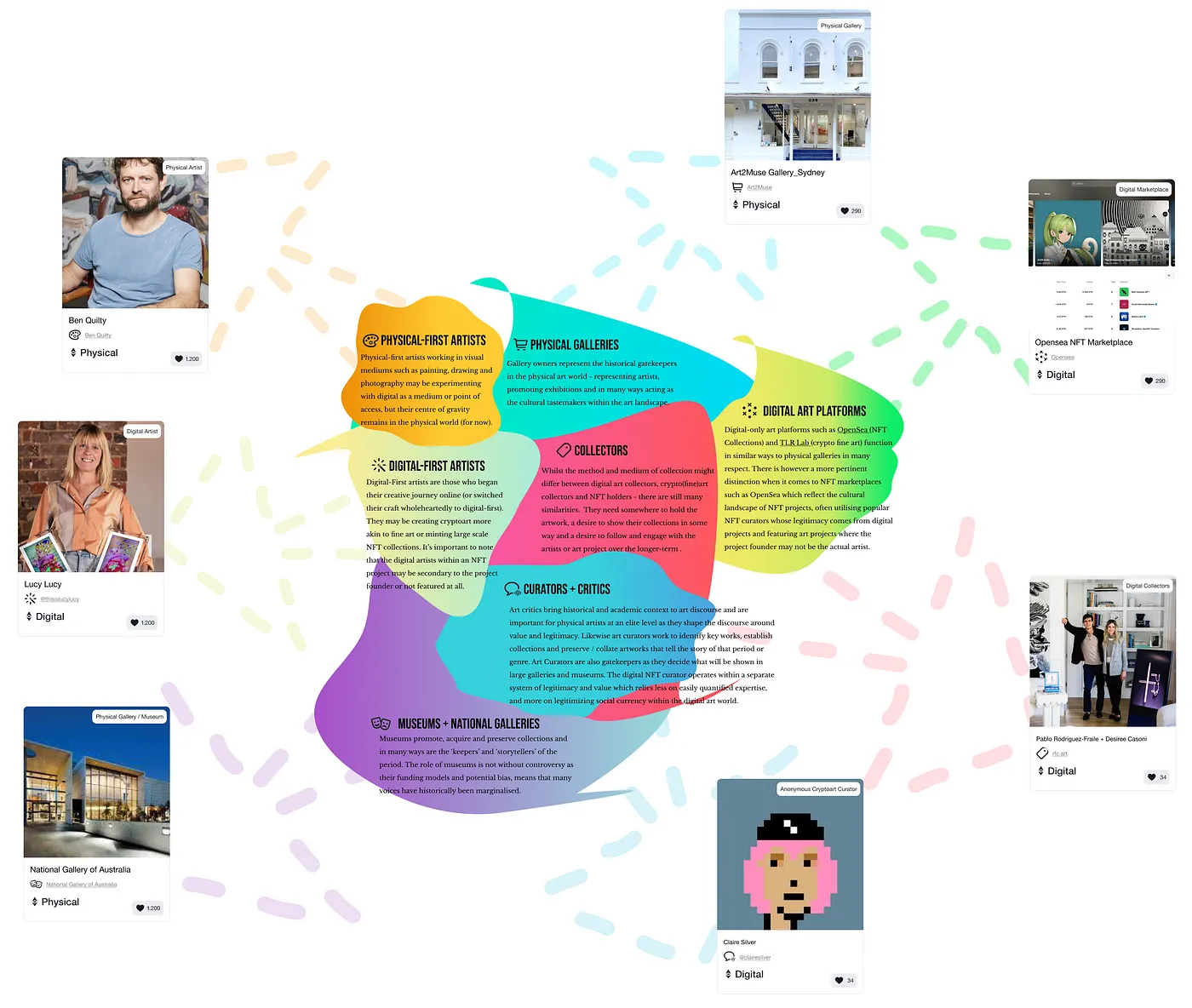

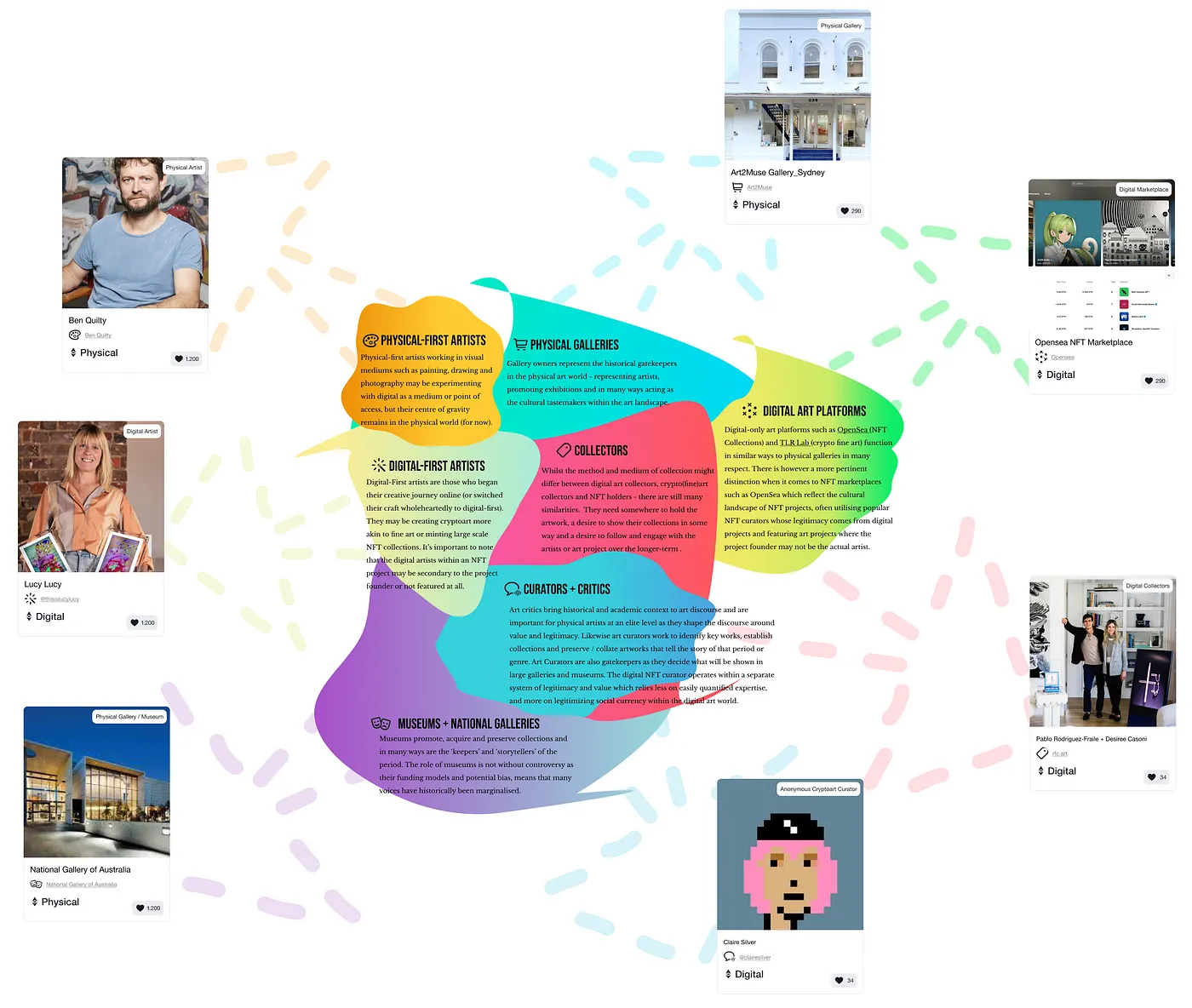

The Stakeholders

The digital art market has shifted the trajectory on both the supply + demand axis.

Despite fluctuating NFT sales, digital artist + collector engagement continues.

Whilst the market for NFTs (non-fungible tokens) surged to $2.5 billion in the first half of 2021, no doubt buoyed by Beeple’s USD$69million sale through Sotheby’s. However NFT sales have slowed significantly since 2021 with the majority of lower levels of NFT sales representing secondary sales over primary purchases (mints). Despite the fluctuating sales, new artists and collectors continue to join the major art platforms like Superrare, Foundation and ArtBlocks.

Digital + Physical | Trial + Error

Whilst declining patronage during Covid forced many museums and galleries online; the industry appears divided about how best to tackle the online space. Physical museums and galleries continue to experiment and adapt within the digital space — Sotheby’s NFT auction of Beeple’s ‘Everydays: First 5000 Days was sold for USD$69million and shook up the traditional art world. Likewise some galleries have joined forces online to exhibit whilst others have shifted to virtual-only exhibitions. Artcrush Gallery takes a different approach, exhibiting NFTs in the physical world via large scale digital billboards which feel more outdoor advertising than art gallery.

Museums have also experimented with the digitization of their works — The British Museum has partnered with LaCollection to release NFT collections; likewise the Whitworth Museum has also launched their own NFT artworks for sale. But there are also concerns some institutions are jumping the gun early without considering the longterm impacts of ‘NFT-ing’ their collections for sale — the Uffizi Gallery minted a single edition NFT of Michelangelo’s Doni Tondo (1505–’06) for $170,000 which industry observers say is concerning as Uffizi no longer has ownership over the NFT for the foreseeable future.

The Digital Protection Dilemma

Authenticity and provenance remain central issues to art collectors (and thus systems of value). NFTs stored on the blockchain have immutable provenance records, and companies like Truepic and Numbers Protocol have introduced decentralised provenance photo capture with no doubt more to come onto the market in the near future. Beyond blockchain authentication and record preservation which provides lineage to ownership; there are also the everyday issues of cryptosecurity and longterm provenance management that this new world of art-as-digital-asset surfaces.Moreover, cases like the scam purchase of a Banksy NFT and increasing cases of artists who discover their work has been ‘NFT’d’ without their permission or the $13.5million dollars worth of stolen BAYC NFTs . . all continue to fuel the uncertainty about this landscape will play out in future.

Systems of access, discovery + distribution are in flux

Incumbent models of distribution and access are problematic. Art galleries act as both tastemakers and gatekeepers, they are the consecrators of value who determine what will be shown and made visible. Museums also function to both preserve and historicize culture through their art collections. Both are problematic in that they operate within the dominant economic system with its internal bias and frameworks of value and legitimacy. Research shows that 85% of artists in U.S. museum collections are white, and 87% are male. There is concern amongst artists that the digital space is being colonised as another distribution and access network, without seeking to capitalise on the opportunity for increased artist discovery and access. Conversely, blockchains potentially represent their own form of exclusivity as collections are minted (and accessed) on one chain versus another.

Cryptoeconomics is catalysing the emergence of new organisational and economic structures

Cryptoeconomic systems are enabling more fluid non-linear, non-hierarchical organisations to form around community and project purposes (eg. DAOs) separate from the mainstream. New economic frameworks enable artists, collectors, curators and viewers to take advantage of (and shape) the shifting trajectories on both the supply and demand axis but how this plays out is still uncertain.

Digital scarcity remains an unresolved issue when it comes to value

Traditional models of art value rely on limited access and production to create value. NFT collections utilise these same structures with limited mints and rare collectibles and auction houses like Sotheby’s are attempting to transfer perceptions of scarcity as value to digital works. The mechanism of scarcity could easily be absorbed into old systems of power, value, distribution and access without realising the potential that the digital space offers for collective transformation of the art ecosystem.

Definitions + demarcations of value and purpose remain unresolved

There is little public understanding or distinction between Cryptoart and NFTs; Kyle Walters in his article Data in the Year of the NFT makes the distinction between Cryptoart (akin to fine art in digital format) versus NFT Art (referring to NFT mint collections. The challenge with these unresolved issues around definition and thus, demarcation of ‘art-as-asset’ classes, is that each functions differently in terms of purpose, function and within particular systems of value. Whilst ‘fine art style’ cryptoart is akin to fine art, NFT art functions as both utility and collectable asset. Further complicating the discourse is the genericization of the term ‘NFT’, which within digital parlance, refers to both art assets (more specifically) and utility tokens within web3 systems of community and governance.Furthermore, ongoing value debates continue about ‘what constitutes art’ with the contentious role of generative AI (in terms of perceived authorship and skill), and also concerns around the ownership of imagery utilised in large language model datasets from which the AI models work.

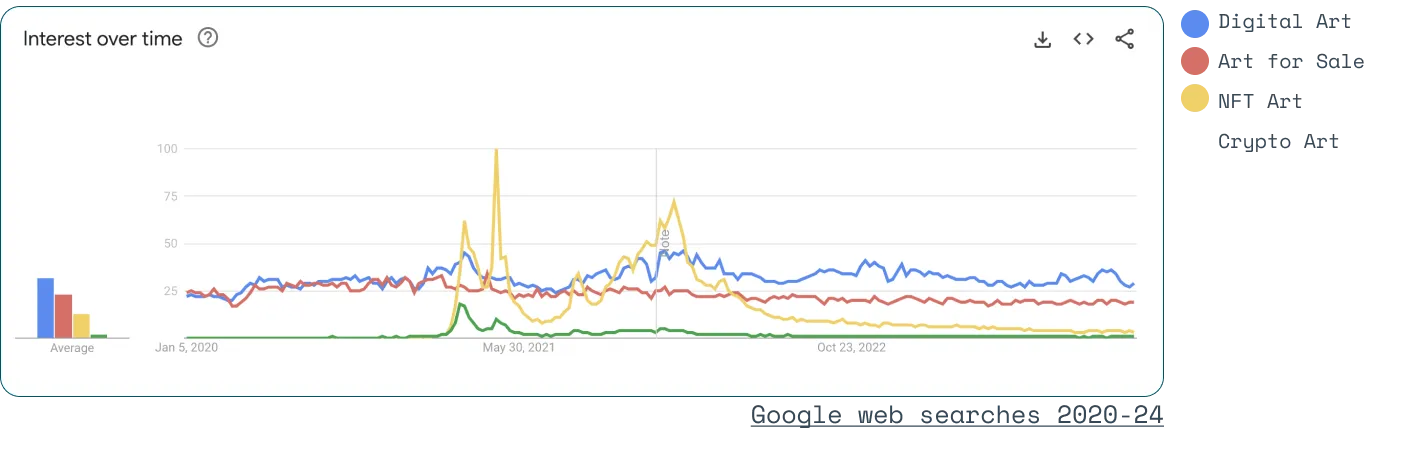

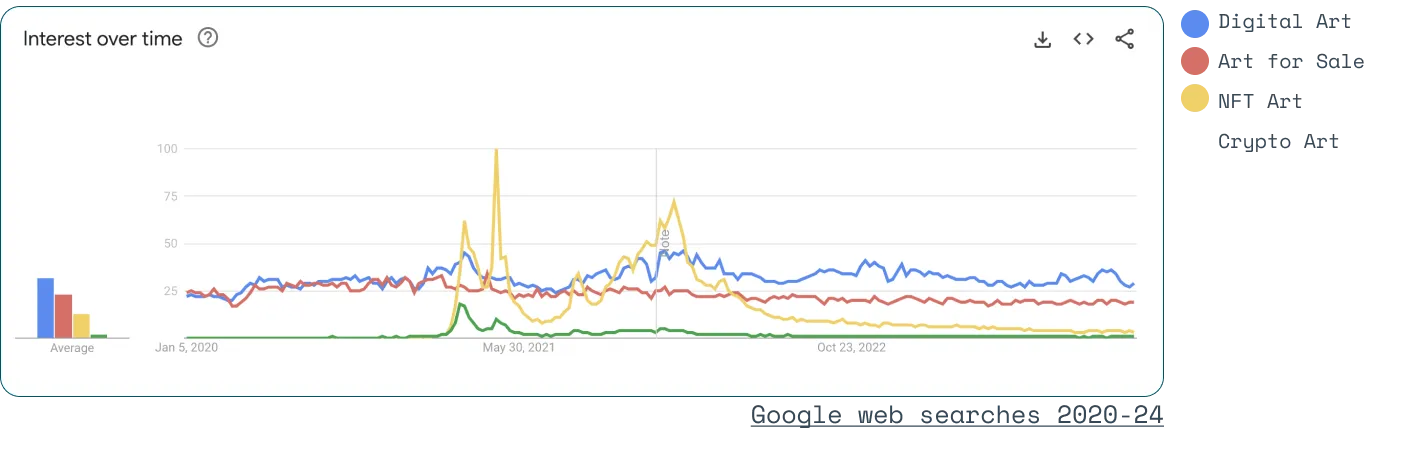

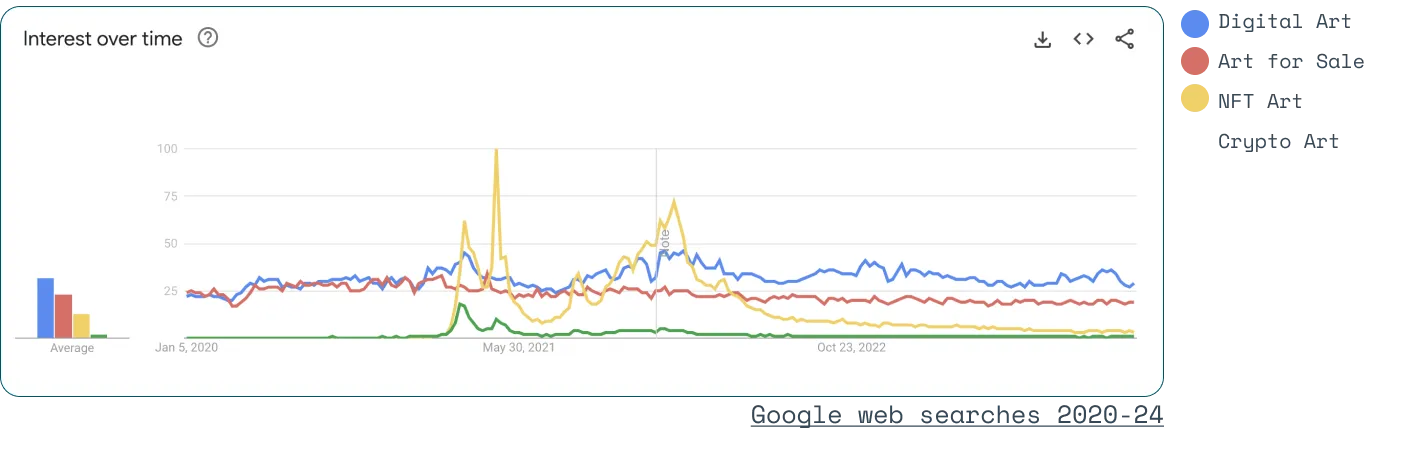

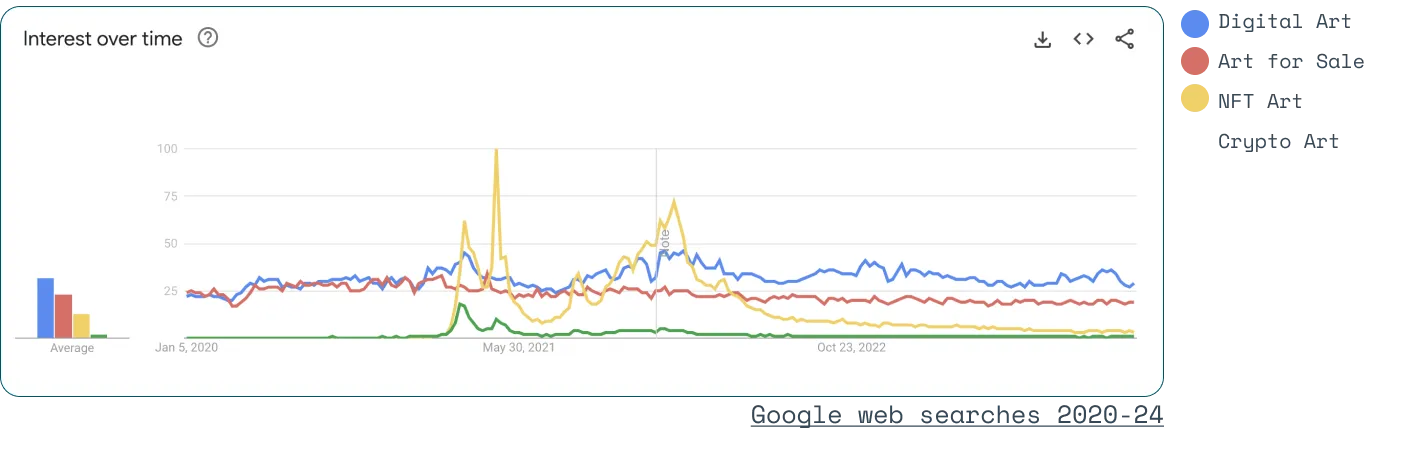

Interest in Digital Art remains steady

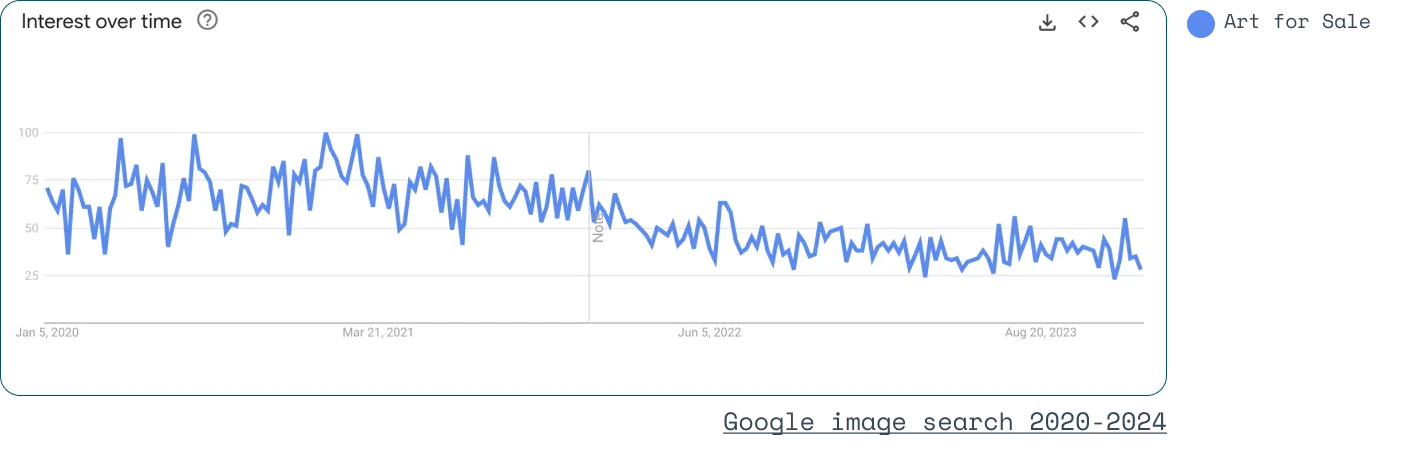

It’s too early to make a call on the commercial future of the digital art market. Whilst sales have declined since the 2021 NFT boom, within the context of global inflation and rising interest rates, many categories have also declined and we see this across ‘cars for sale’ and ‘bikes for sale’ search trends — so it’s too early to make a call on whether the digital art market has a commercial future and indeed industry analysts are forecasting 34.2% growth per year into the future.

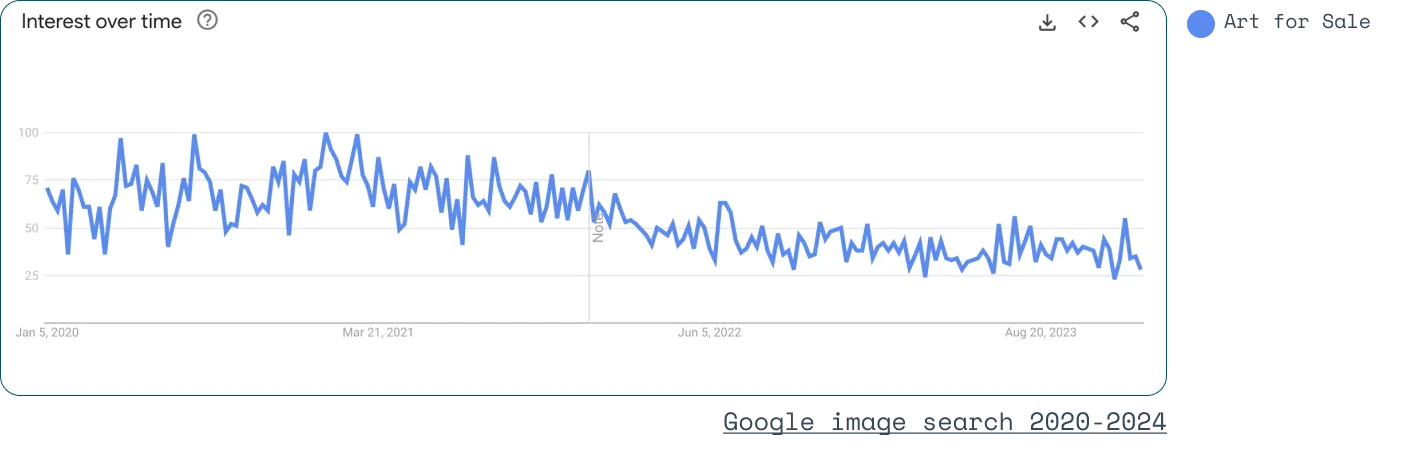

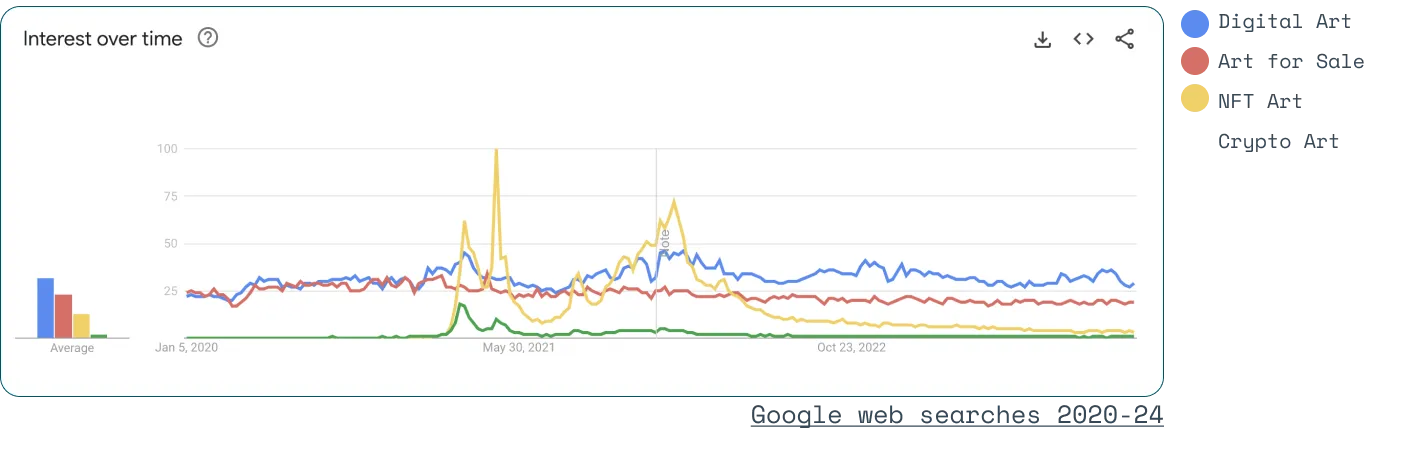

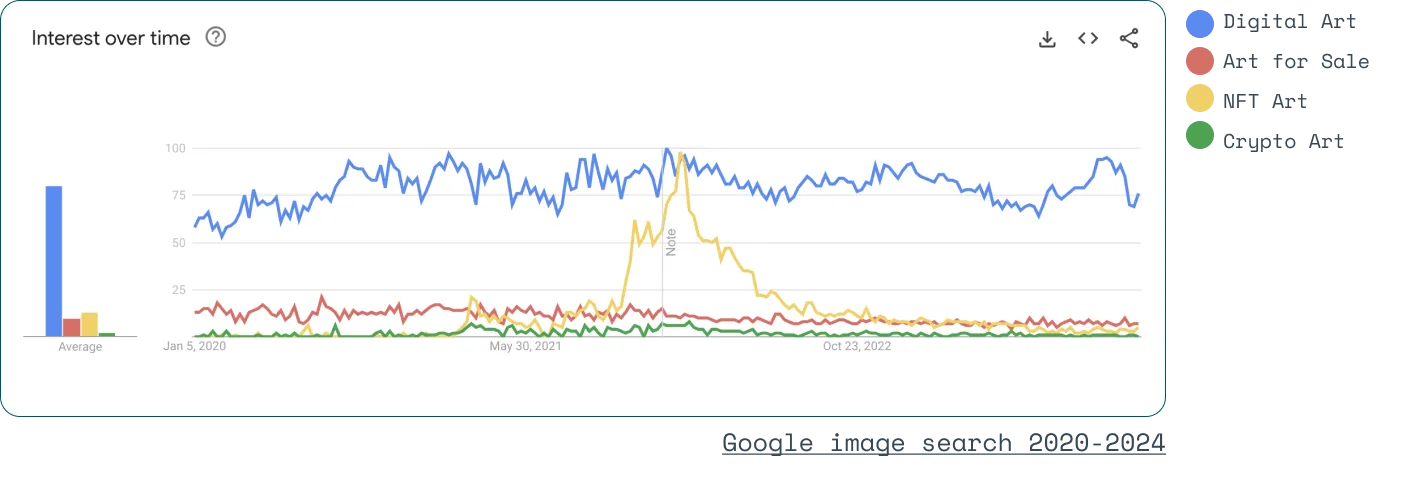

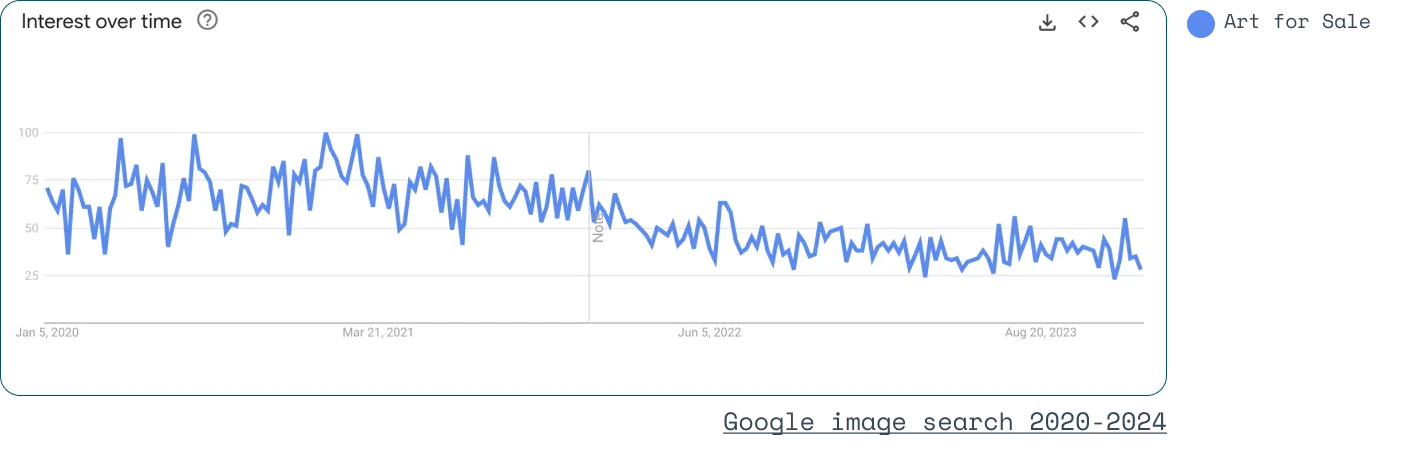

Global Google Web Searches show that global online interest in ‘Digital Art’ + ‘Art for Sale’ remains steady with an overall increase in ‘Digital Art’ since 2020. ‘NFT Art’ increased during the 2021 boom and has declined since then. ‘Crypto Art’ also increased during the boom but also dropped off.

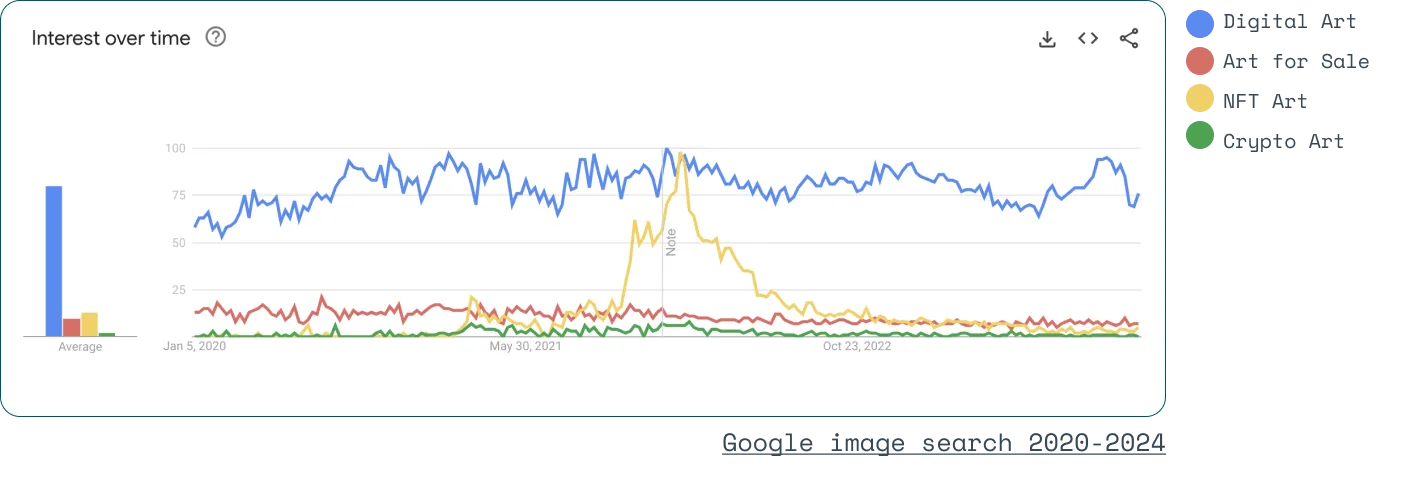

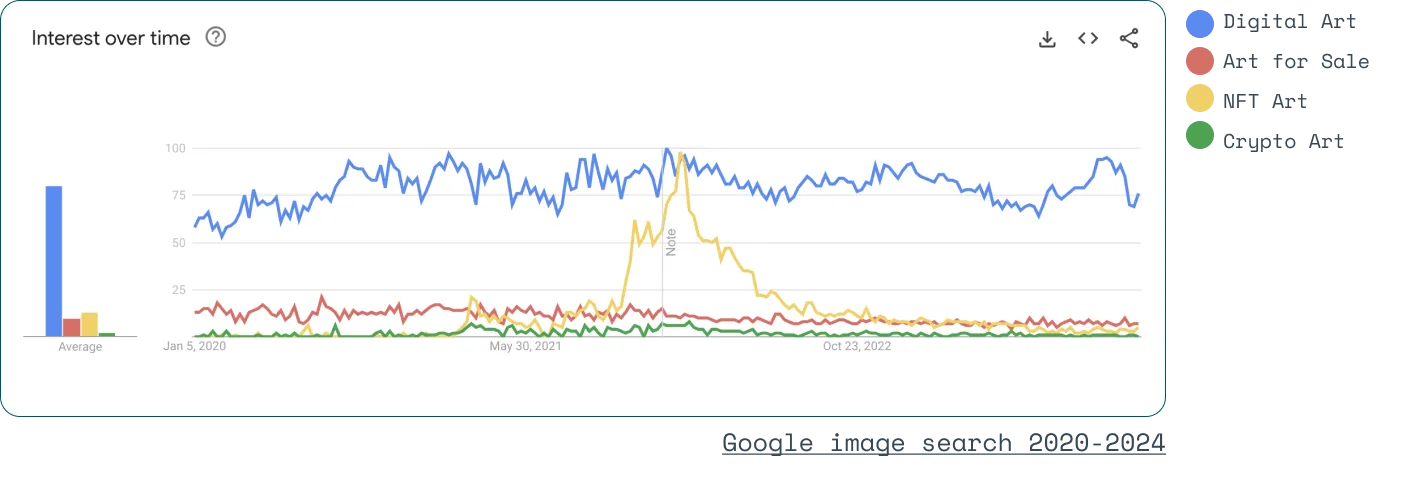

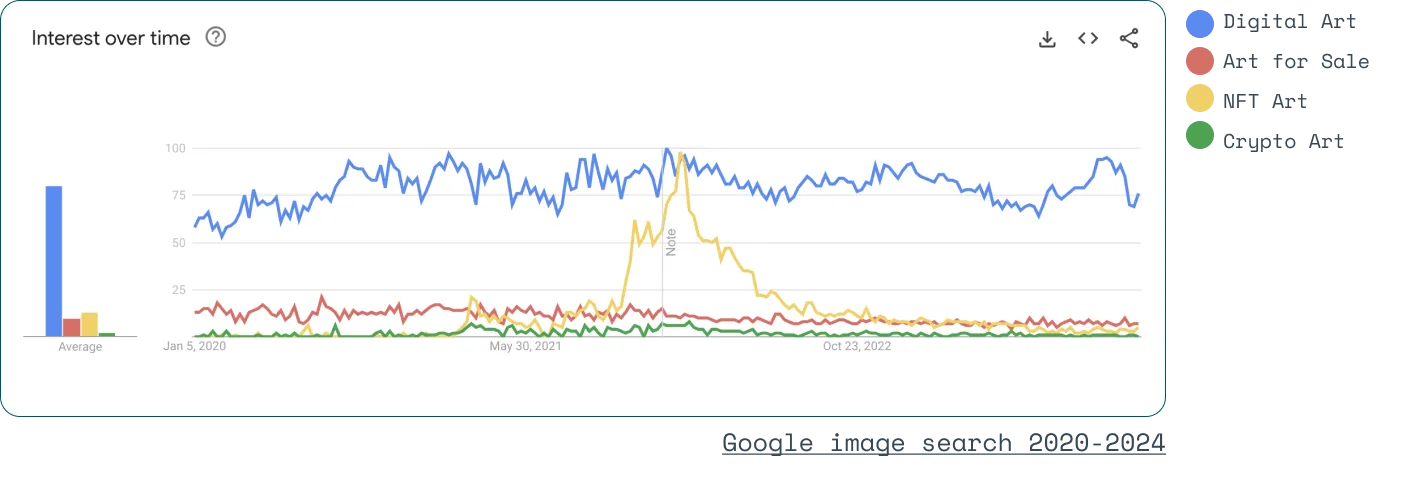

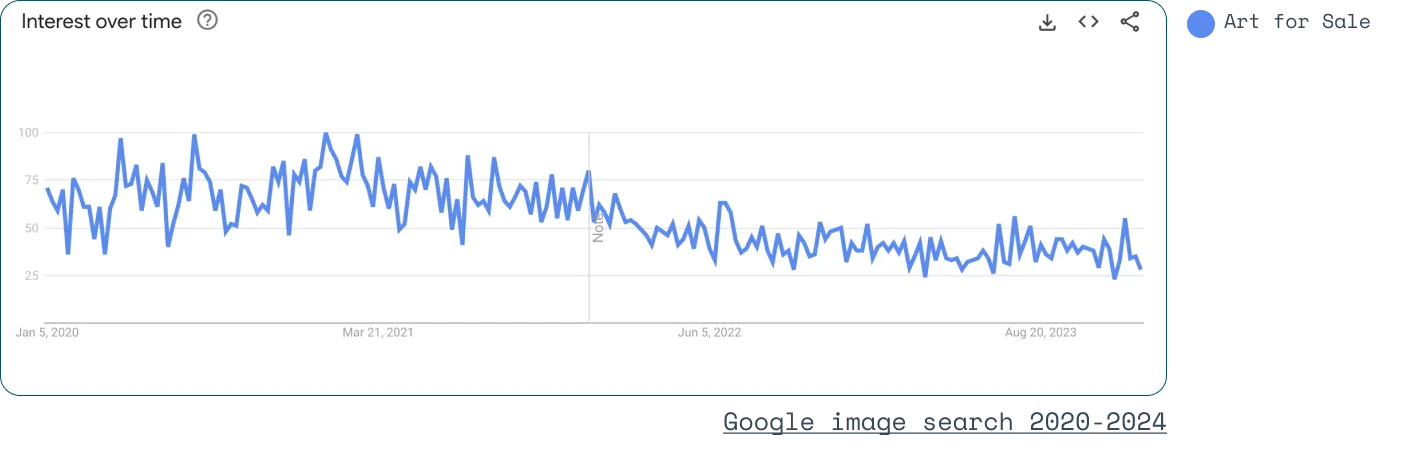

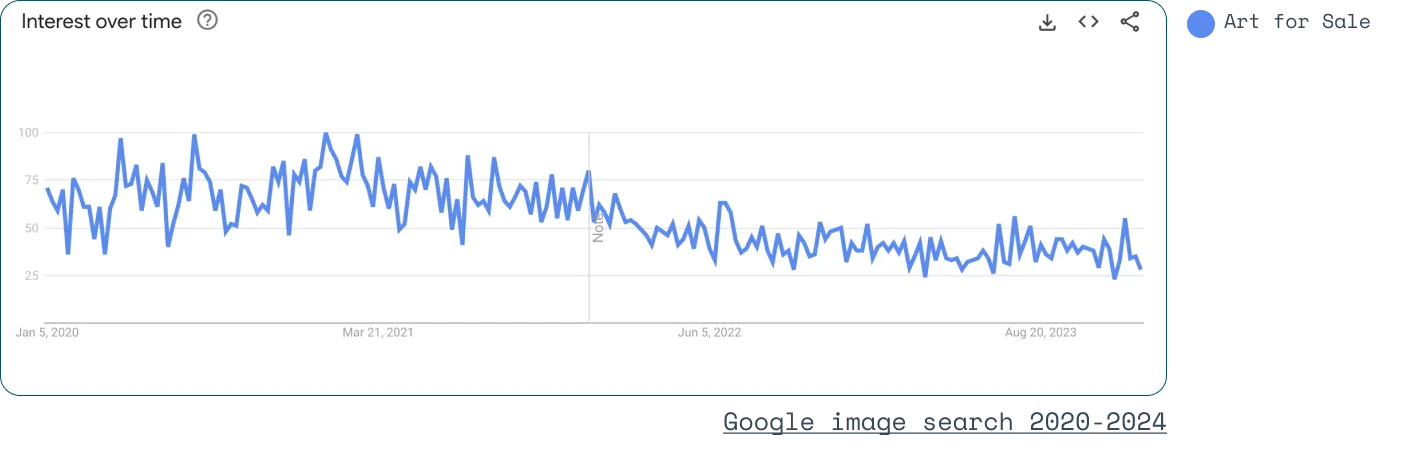

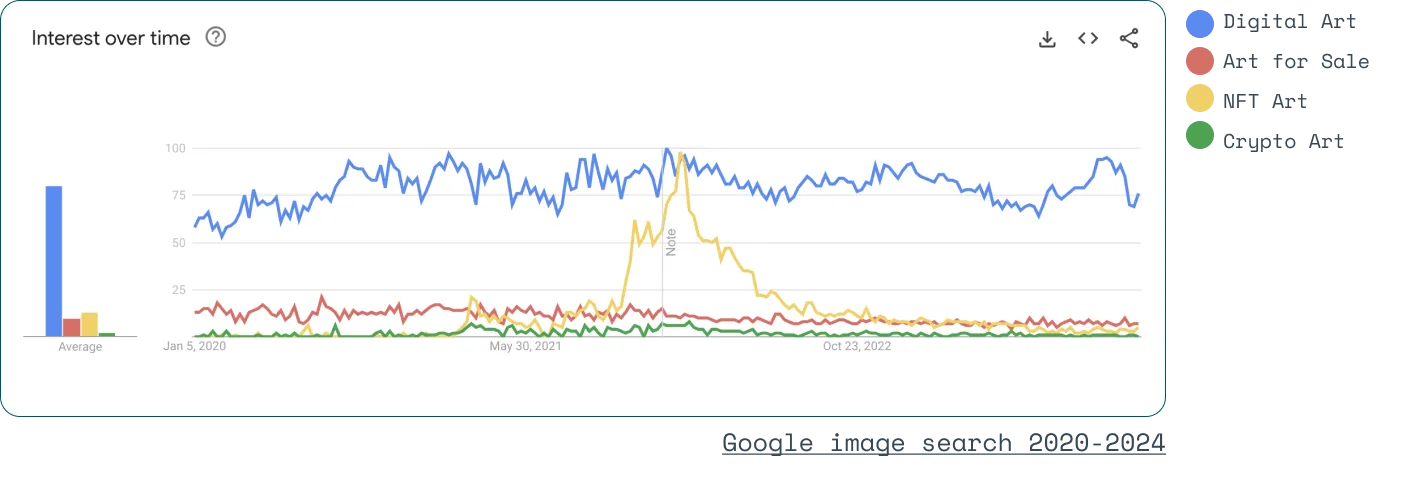

Global Google Images Searches suggest that ‘Digital Art’ has maintained momentum over the past 4 years; suggesting that whilst purchase intent (users looking for NFT and crypto art) has declined post-boom, interest in digital art still remains high.

According to the recently published Art Basel and UBS Global Art Market Report 2023 sales of collectible and art-related NFTs transacted through online platforms reached a remarkable $US13.3 billion in 2022.

Do we want to know whether the digital art market is economically viable + valuable? Or whether it plays an important role in the art space?

The other question these market forecasts surface is — how do we identify the ‘importance’ of the digital art market? By commercial dollars traded? What does that say about how we think about the role of art?

Trends

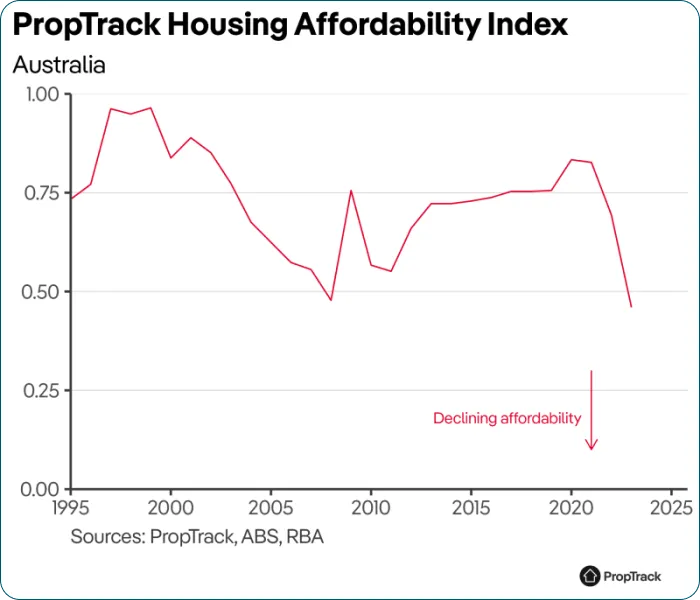

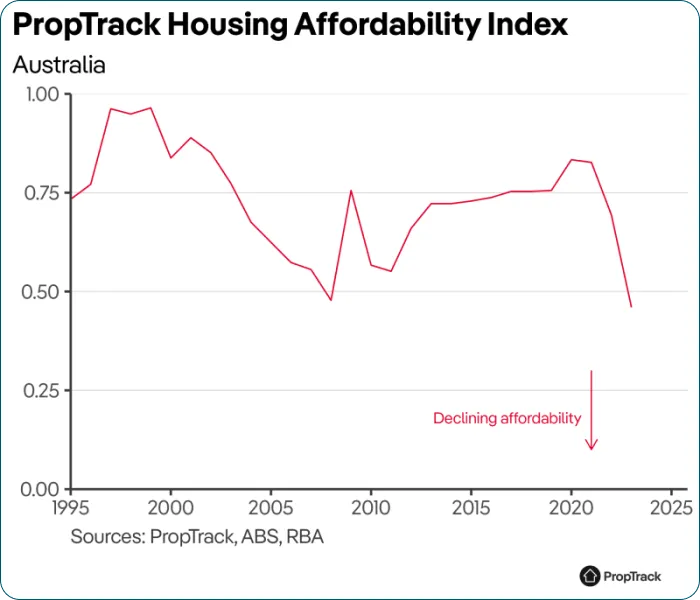

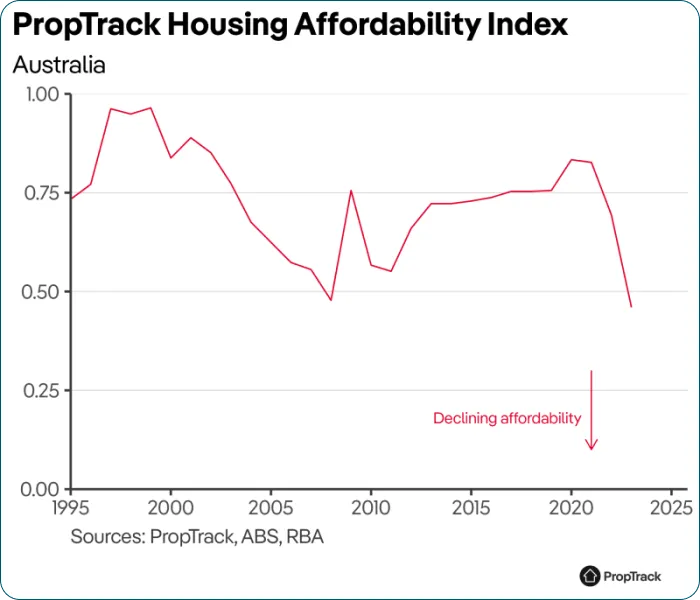

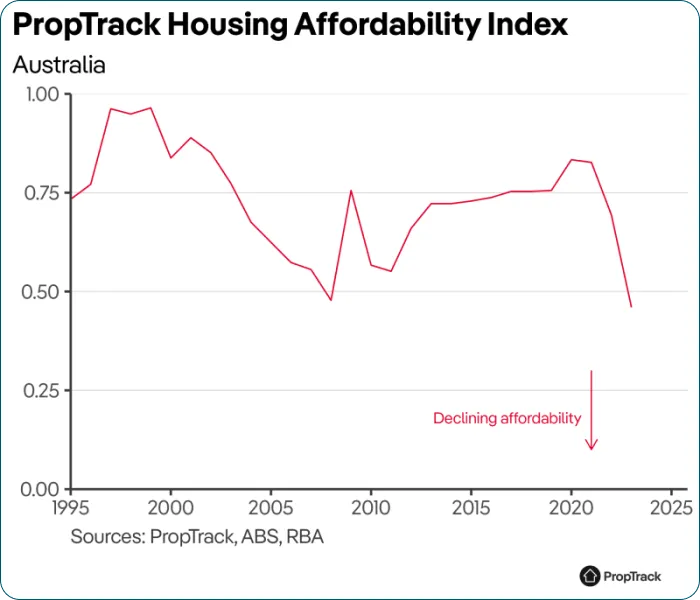

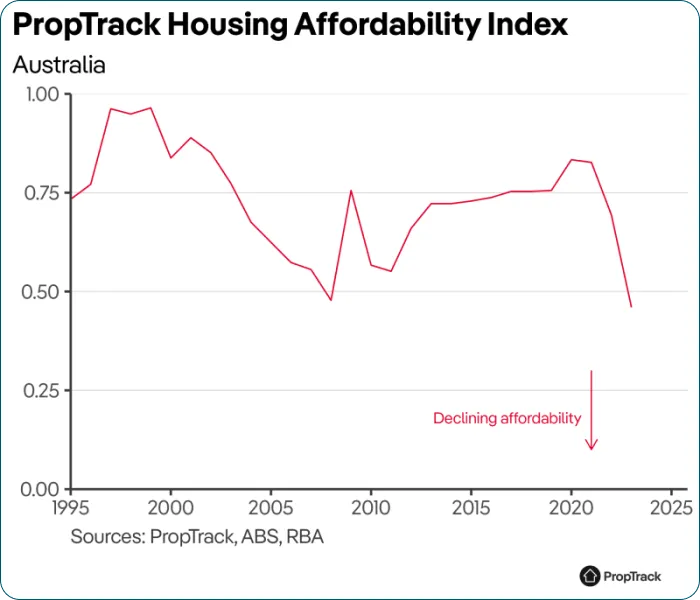

Australian Housing Affordability Index

Housing Affordability ↓ As housing affordability continues to decline in Australia and around the world, we may see interest in non-physical art amongst younger collectors rise.

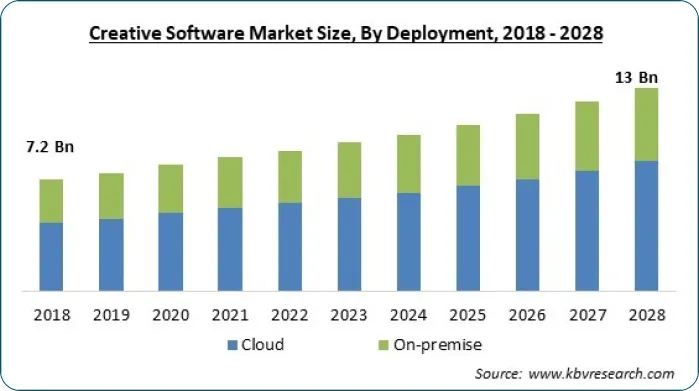

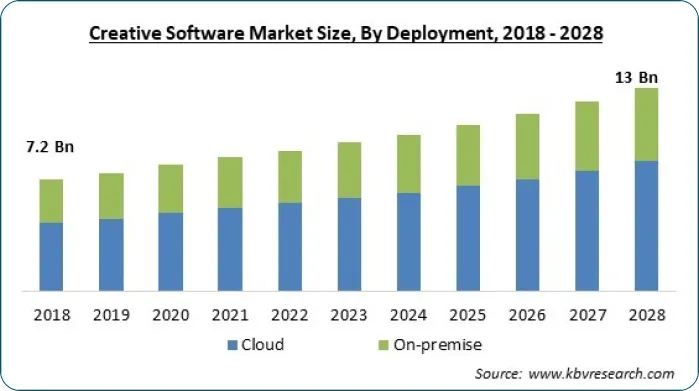

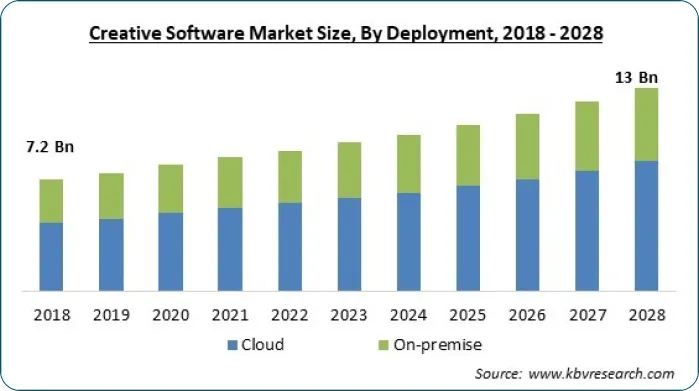

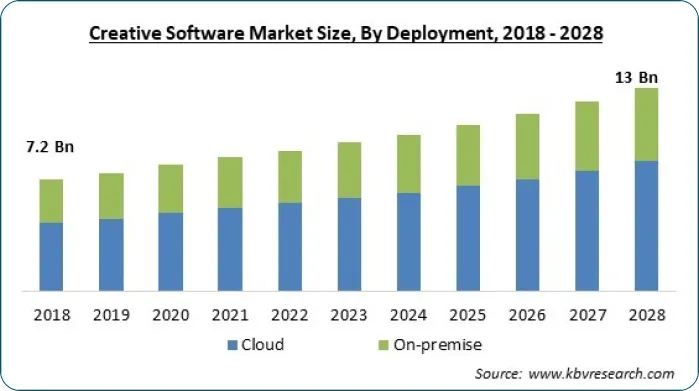

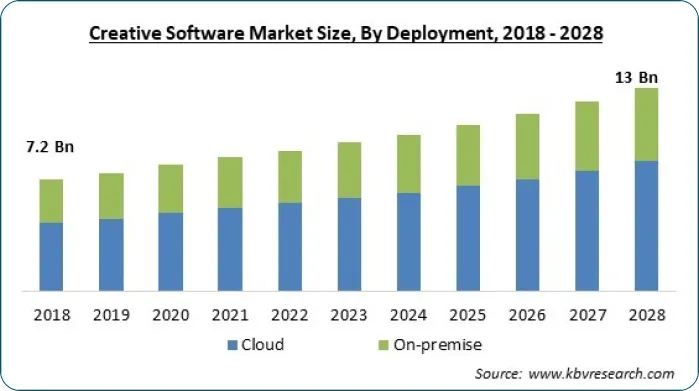

KVB Market Research Report

Creative Software Market ↑ The creative software market driven by business, continues to rise, adding to the already exploding landscape of creative digital tools and platforms.

The Role of Art within Cultural EcoSystems

The Future Art EcoSystems Report identify two defining system structures for the future of digital art:

The idea of the tech industry operating as art patron

The development of vertically integrated ‘art stacks’ which cut out the conventional constraints of the historical system.

The latest thinking from Carnegie Mellon points to an emerging role of Art within Smart Cities as a form of connection and communication; both as an imaginative process of engagement and reinforcing a sense of identity and place amongst residents.A recent report developed by Changeist in collaboration with Arup, ArtScience Museum Singapore and Audience Labs notes ecosystems, business models and funding as key areas for future focus, along with the social value of art and equity / inclusivity. It also presents ‘digital stages’ of new creators, audiences and tools as reshaping the future landscape.

///

The Futures of Art in a Post-digital World

This post forms part of a much larger project around 'Post-digital Art Futures', further posts can be viewed below:

Exploring the Digital Art EcoSystem : How might the future role and value of Visual Art be transformed in a post-digital world?

Critical Tensions and Transformations Emerging within the Digital Art EcoSystem : Will a crypto-based art economy ever fulfil its promise of emancipation from the historical systems of access, power and value?

A Hypothesis of Change : Exploring potential forces of change shaping emergent futures within the art ecosystem

A New Social Operating System : What role might art play in our ability to imagine alternative positive human futures?

Possible Art Futures : Three Stories of (Post) Growth, power, Art, Ecology and Activism

You can view the extended versions of the three alternate futures narratives hereCivic Imagination : Transforming Governance for a Connected Future - speculative designs

Exploring the Domain + Key Lines of Enquiry

How might we might think more critically about the emerging economic models and systems of value & legitimacy that the Digital Art World invites; and their implications for the future role and value of all Art in the Post-Digital Age?

Defining Post-digital / For the purposes of clarity, I use the term’ post-digital’ to describe the period in which our intense historical fascination with all things digital has passed and we accept digital as being a core part of both society and the systems within it, rather than to describe some disenchantment or withdrawal from it.

How are systems of meaning and value being reshaped in the digital space?

How will the online merging of selling & critiquing shape our future ideas of the legitimacy of art?

How will the cultural context that is specific to the internet, change the way we think about collectable Art?

How are advancements in technology and digital platforms reshaping the role of the artist, enabling new forms of creative expression and expanding artistic boundaries?

If all art processes occur within a social and cultural context, how might the digital art space refocus the idea of art-making and production as a collective process?

How might this impact the systems operating within the art world?

In what ways might we see the systemic issues operating within the Arts economy, as representative of the broader economy in general?

There’s no question that NFTs will ever replace physical art completely, but they will disrupt the physical visual art industry and the systems within which it operates, in some way.It’s also interesting to consider the traditional Art Industry as an economic system representative of the broader economy; upon which the same power dynamics, economic structures and distribution models assign value, restrict access, cultivate inequity and amplify the widening gap between value creation and value extraction.

The Economics of Art

Those who completely dismiss digital art have much to lose and as long as artists perceive scarcity and physicality as the only route to true legitimacy and value, they will be forever beholden to these systemic structures of inequality.So when we explore visual art in the post-digital age; we are exploring the realm of the artist and the impact of digital technology but more importantly, we are exploring the shifting dynamics in both the domain (culture) and the field (society) at large — and how this challenges historical structures of wealth, power, value and legitimacy.

The Stakeholders

The digital art market has shifted the trajectory on both the supply + demand axis.

Despite fluctuating NFT sales, digital artist + collector engagement continues.

Whilst the market for NFTs (non-fungible tokens) surged to $2.5 billion in the first half of 2021, no doubt buoyed by Beeple’s USD$69million sale through Sotheby’s. However NFT sales have slowed significantly since 2021 with the majority of lower levels of NFT sales representing secondary sales over primary purchases (mints). Despite the fluctuating sales, new artists and collectors continue to join the major art platforms like Superrare, Foundation and ArtBlocks.

Digital + Physical | Trial + Error

Whilst declining patronage during Covid forced many museums and galleries online; the industry appears divided about how best to tackle the online space. Physical museums and galleries continue to experiment and adapt within the digital space — Sotheby’s NFT auction of Beeple’s ‘Everydays: First 5000 Days was sold for USD$69million and shook up the traditional art world. Likewise some galleries have joined forces online to exhibit whilst others have shifted to virtual-only exhibitions. Artcrush Gallery takes a different approach, exhibiting NFTs in the physical world via large scale digital billboards which feel more outdoor advertising than art gallery.

Museums have also experimented with the digitization of their works — The British Museum has partnered with LaCollection to release NFT collections; likewise the Whitworth Museum has also launched their own NFT artworks for sale. But there are also concerns some institutions are jumping the gun early without considering the longterm impacts of ‘NFT-ing’ their collections for sale — the Uffizi Gallery minted a single edition NFT of Michelangelo’s Doni Tondo (1505–’06) for $170,000 which industry observers say is concerning as Uffizi no longer has ownership over the NFT for the foreseeable future.

The Digital Protection Dilemma

Authenticity and provenance remain central issues to art collectors (and thus systems of value). NFTs stored on the blockchain have immutable provenance records, and companies like Truepic and Numbers Protocol have introduced decentralised provenance photo capture with no doubt more to come onto the market in the near future. Beyond blockchain authentication and record preservation which provides lineage to ownership; there are also the everyday issues of cryptosecurity and longterm provenance management that this new world of art-as-digital-asset surfaces.Moreover, cases like the scam purchase of a Banksy NFT and increasing cases of artists who discover their work has been ‘NFT’d’ without their permission or the $13.5million dollars worth of stolen BAYC NFTs . . all continue to fuel the uncertainty about this landscape will play out in future.

Systems of access, discovery + distribution are in flux

Incumbent models of distribution and access are problematic. Art galleries act as both tastemakers and gatekeepers, they are the consecrators of value who determine what will be shown and made visible. Museums also function to both preserve and historicize culture through their art collections. Both are problematic in that they operate within the dominant economic system with its internal bias and frameworks of value and legitimacy. Research shows that 85% of artists in U.S. museum collections are white, and 87% are male. There is concern amongst artists that the digital space is being colonised as another distribution and access network, without seeking to capitalise on the opportunity for increased artist discovery and access. Conversely, blockchains potentially represent their own form of exclusivity as collections are minted (and accessed) on one chain versus another.

Cryptoeconomics is catalysing the emergence of new organisational and economic structures

Cryptoeconomic systems are enabling more fluid non-linear, non-hierarchical organisations to form around community and project purposes (eg. DAOs) separate from the mainstream. New economic frameworks enable artists, collectors, curators and viewers to take advantage of (and shape) the shifting trajectories on both the supply and demand axis but how this plays out is still uncertain.

Digital scarcity remains an unresolved issue when it comes to value

Traditional models of art value rely on limited access and production to create value. NFT collections utilise these same structures with limited mints and rare collectibles and auction houses like Sotheby’s are attempting to transfer perceptions of scarcity as value to digital works. The mechanism of scarcity could easily be absorbed into old systems of power, value, distribution and access without realising the potential that the digital space offers for collective transformation of the art ecosystem.

Definitions + demarcations of value and purpose remain unresolved

There is little public understanding or distinction between Cryptoart and NFTs; Kyle Walters in his article Data in the Year of the NFT makes the distinction between Cryptoart (akin to fine art in digital format) versus NFT Art (referring to NFT mint collections. The challenge with these unresolved issues around definition and thus, demarcation of ‘art-as-asset’ classes, is that each functions differently in terms of purpose, function and within particular systems of value. Whilst ‘fine art style’ cryptoart is akin to fine art, NFT art functions as both utility and collectable asset. Further complicating the discourse is the genericization of the term ‘NFT’, which within digital parlance, refers to both art assets (more specifically) and utility tokens within web3 systems of community and governance.Furthermore, ongoing value debates continue about ‘what constitutes art’ with the contentious role of generative AI (in terms of perceived authorship and skill), and also concerns around the ownership of imagery utilised in large language model datasets from which the AI models work.

Interest in Digital Art remains steady

It’s too early to make a call on the commercial future of the digital art market. Whilst sales have declined since the 2021 NFT boom, within the context of global inflation and rising interest rates, many categories have also declined and we see this across ‘cars for sale’ and ‘bikes for sale’ search trends — so it’s too early to make a call on whether the digital art market has a commercial future and indeed industry analysts are forecasting 34.2% growth per year into the future.

Global Google Web Searches show that global online interest in ‘Digital Art’ + ‘Art for Sale’ remains steady with an overall increase in ‘Digital Art’ since 2020. ‘NFT Art’ increased during the 2021 boom and has declined since then. ‘Crypto Art’ also increased during the boom but also dropped off.

Global Google Images Searches suggest that ‘Digital Art’ has maintained momentum over the past 4 years; suggesting that whilst purchase intent (users looking for NFT and crypto art) has declined post-boom, interest in digital art still remains high.

According to the recently published Art Basel and UBS Global Art Market Report 2023 sales of collectible and art-related NFTs transacted through online platforms reached a remarkable $US13.3 billion in 2022.

Do we want to know whether the digital art market is economically viable + valuable? Or whether it plays an important role in the art space?

The other question these market forecasts surface is — how do we identify the ‘importance’ of the digital art market? By commercial dollars traded? What does that say about how we think about the role of art?

Trends

Australian Housing Affordability Index

Housing Affordability ↓ As housing affordability continues to decline in Australia and around the world, we may see interest in non-physical art amongst younger collectors rise.

KVB Market Research Report

Creative Software Market ↑ The creative software market driven by business, continues to rise, adding to the already exploding landscape of creative digital tools and platforms.

The Role of Art within Cultural EcoSystems

The Future Art EcoSystems Report identify two defining system structures for the future of digital art:

The idea of the tech industry operating as art patron

The development of vertically integrated ‘art stacks’ which cut out the conventional constraints of the historical system.

The latest thinking from Carnegie Mellon points to an emerging role of Art within Smart Cities as a form of connection and communication; both as an imaginative process of engagement and reinforcing a sense of identity and place amongst residents.A recent report developed by Changeist in collaboration with Arup, ArtScience Museum Singapore and Audience Labs notes ecosystems, business models and funding as key areas for future focus, along with the social value of art and equity / inclusivity. It also presents ‘digital stages’ of new creators, audiences and tools as reshaping the future landscape.

///

The Futures of Art in a Post-digital World

This post forms part of a much larger project around 'Post-digital Art Futures', further posts can be viewed below:

Exploring the Digital Art EcoSystem : How might the future role and value of Visual Art be transformed in a post-digital world?

Critical Tensions and Transformations Emerging within the Digital Art EcoSystem : Will a crypto-based art economy ever fulfil its promise of emancipation from the historical systems of access, power and value?

A Hypothesis of Change : Exploring potential forces of change shaping emergent futures within the art ecosystem

A New Social Operating System : What role might art play in our ability to imagine alternative positive human futures?

Possible Art Futures : Three Stories of (Post) Growth, power, Art, Ecology and Activism

You can view the extended versions of the three alternate futures narratives hereCivic Imagination : Transforming Governance for a Connected Future - speculative designs

Exploring the Domain + Key Lines of Enquiry

How might we might think more critically about the emerging economic models and systems of value & legitimacy that the Digital Art World invites; and their implications for the future role and value of all Art in the Post-Digital Age?

Defining Post-digital / For the purposes of clarity, I use the term’ post-digital’ to describe the period in which our intense historical fascination with all things digital has passed and we accept digital as being a core part of both society and the systems within it, rather than to describe some disenchantment or withdrawal from it.

How are systems of meaning and value being reshaped in the digital space?

How will the online merging of selling & critiquing shape our future ideas of the legitimacy of art?

How will the cultural context that is specific to the internet, change the way we think about collectable Art?

How are advancements in technology and digital platforms reshaping the role of the artist, enabling new forms of creative expression and expanding artistic boundaries?

If all art processes occur within a social and cultural context, how might the digital art space refocus the idea of art-making and production as a collective process?

How might this impact the systems operating within the art world?

In what ways might we see the systemic issues operating within the Arts economy, as representative of the broader economy in general?

There’s no question that NFTs will ever replace physical art completely, but they will disrupt the physical visual art industry and the systems within which it operates, in some way.It’s also interesting to consider the traditional Art Industry as an economic system representative of the broader economy; upon which the same power dynamics, economic structures and distribution models assign value, restrict access, cultivate inequity and amplify the widening gap between value creation and value extraction.

The Economics of Art

Those who completely dismiss digital art have much to lose and as long as artists perceive scarcity and physicality as the only route to true legitimacy and value, they will be forever beholden to these systemic structures of inequality.So when we explore visual art in the post-digital age; we are exploring the realm of the artist and the impact of digital technology but more importantly, we are exploring the shifting dynamics in both the domain (culture) and the field (society) at large — and how this challenges historical structures of wealth, power, value and legitimacy.

The Stakeholders

The digital art market has shifted the trajectory on both the supply + demand axis.

Despite fluctuating NFT sales, digital artist + collector engagement continues.

Whilst the market for NFTs (non-fungible tokens) surged to $2.5 billion in the first half of 2021, no doubt buoyed by Beeple’s USD$69million sale through Sotheby’s. However NFT sales have slowed significantly since 2021 with the majority of lower levels of NFT sales representing secondary sales over primary purchases (mints). Despite the fluctuating sales, new artists and collectors continue to join the major art platforms like Superrare, Foundation and ArtBlocks.

Digital + Physical | Trial + Error

Whilst declining patronage during Covid forced many museums and galleries online; the industry appears divided about how best to tackle the online space. Physical museums and galleries continue to experiment and adapt within the digital space — Sotheby’s NFT auction of Beeple’s ‘Everydays: First 5000 Days was sold for USD$69million and shook up the traditional art world. Likewise some galleries have joined forces online to exhibit whilst others have shifted to virtual-only exhibitions. Artcrush Gallery takes a different approach, exhibiting NFTs in the physical world via large scale digital billboards which feel more outdoor advertising than art gallery.

Museums have also experimented with the digitization of their works — The British Museum has partnered with LaCollection to release NFT collections; likewise the Whitworth Museum has also launched their own NFT artworks for sale. But there are also concerns some institutions are jumping the gun early without considering the longterm impacts of ‘NFT-ing’ their collections for sale — the Uffizi Gallery minted a single edition NFT of Michelangelo’s Doni Tondo (1505–’06) for $170,000 which industry observers say is concerning as Uffizi no longer has ownership over the NFT for the foreseeable future.

The Digital Protection Dilemma

Authenticity and provenance remain central issues to art collectors (and thus systems of value). NFTs stored on the blockchain have immutable provenance records, and companies like Truepic and Numbers Protocol have introduced decentralised provenance photo capture with no doubt more to come onto the market in the near future. Beyond blockchain authentication and record preservation which provides lineage to ownership; there are also the everyday issues of cryptosecurity and longterm provenance management that this new world of art-as-digital-asset surfaces.Moreover, cases like the scam purchase of a Banksy NFT and increasing cases of artists who discover their work has been ‘NFT’d’ without their permission or the $13.5million dollars worth of stolen BAYC NFTs . . all continue to fuel the uncertainty about this landscape will play out in future.

Systems of access, discovery + distribution are in flux

Incumbent models of distribution and access are problematic. Art galleries act as both tastemakers and gatekeepers, they are the consecrators of value who determine what will be shown and made visible. Museums also function to both preserve and historicize culture through their art collections. Both are problematic in that they operate within the dominant economic system with its internal bias and frameworks of value and legitimacy. Research shows that 85% of artists in U.S. museum collections are white, and 87% are male. There is concern amongst artists that the digital space is being colonised as another distribution and access network, without seeking to capitalise on the opportunity for increased artist discovery and access. Conversely, blockchains potentially represent their own form of exclusivity as collections are minted (and accessed) on one chain versus another.

Cryptoeconomics is catalysing the emergence of new organisational and economic structures

Cryptoeconomic systems are enabling more fluid non-linear, non-hierarchical organisations to form around community and project purposes (eg. DAOs) separate from the mainstream. New economic frameworks enable artists, collectors, curators and viewers to take advantage of (and shape) the shifting trajectories on both the supply and demand axis but how this plays out is still uncertain.

Digital scarcity remains an unresolved issue when it comes to value

Traditional models of art value rely on limited access and production to create value. NFT collections utilise these same structures with limited mints and rare collectibles and auction houses like Sotheby’s are attempting to transfer perceptions of scarcity as value to digital works. The mechanism of scarcity could easily be absorbed into old systems of power, value, distribution and access without realising the potential that the digital space offers for collective transformation of the art ecosystem.

Definitions + demarcations of value and purpose remain unresolved

There is little public understanding or distinction between Cryptoart and NFTs; Kyle Walters in his article Data in the Year of the NFT makes the distinction between Cryptoart (akin to fine art in digital format) versus NFT Art (referring to NFT mint collections. The challenge with these unresolved issues around definition and thus, demarcation of ‘art-as-asset’ classes, is that each functions differently in terms of purpose, function and within particular systems of value. Whilst ‘fine art style’ cryptoart is akin to fine art, NFT art functions as both utility and collectable asset. Further complicating the discourse is the genericization of the term ‘NFT’, which within digital parlance, refers to both art assets (more specifically) and utility tokens within web3 systems of community and governance.Furthermore, ongoing value debates continue about ‘what constitutes art’ with the contentious role of generative AI (in terms of perceived authorship and skill), and also concerns around the ownership of imagery utilised in large language model datasets from which the AI models work.

Interest in Digital Art remains steady

It’s too early to make a call on the commercial future of the digital art market. Whilst sales have declined since the 2021 NFT boom, within the context of global inflation and rising interest rates, many categories have also declined and we see this across ‘cars for sale’ and ‘bikes for sale’ search trends — so it’s too early to make a call on whether the digital art market has a commercial future and indeed industry analysts are forecasting 34.2% growth per year into the future.

Global Google Web Searches show that global online interest in ‘Digital Art’ + ‘Art for Sale’ remains steady with an overall increase in ‘Digital Art’ since 2020. ‘NFT Art’ increased during the 2021 boom and has declined since then. ‘Crypto Art’ also increased during the boom but also dropped off.

Global Google Images Searches suggest that ‘Digital Art’ has maintained momentum over the past 4 years; suggesting that whilst purchase intent (users looking for NFT and crypto art) has declined post-boom, interest in digital art still remains high.

According to the recently published Art Basel and UBS Global Art Market Report 2023 sales of collectible and art-related NFTs transacted through online platforms reached a remarkable $US13.3 billion in 2022.

Do we want to know whether the digital art market is economically viable + valuable? Or whether it plays an important role in the art space?

The other question these market forecasts surface is — how do we identify the ‘importance’ of the digital art market? By commercial dollars traded? What does that say about how we think about the role of art?

Trends

Australian Housing Affordability Index

Housing Affordability ↓ As housing affordability continues to decline in Australia and around the world, we may see interest in non-physical art amongst younger collectors rise.

KVB Market Research Report

Creative Software Market ↑ The creative software market driven by business, continues to rise, adding to the already exploding landscape of creative digital tools and platforms.

The Role of Art within Cultural EcoSystems

The Future Art EcoSystems Report identify two defining system structures for the future of digital art:

The idea of the tech industry operating as art patron

The development of vertically integrated ‘art stacks’ which cut out the conventional constraints of the historical system.

The latest thinking from Carnegie Mellon points to an emerging role of Art within Smart Cities as a form of connection and communication; both as an imaginative process of engagement and reinforcing a sense of identity and place amongst residents.A recent report developed by Changeist in collaboration with Arup, ArtScience Museum Singapore and Audience Labs notes ecosystems, business models and funding as key areas for future focus, along with the social value of art and equity / inclusivity. It also presents ‘digital stages’ of new creators, audiences and tools as reshaping the future landscape.

///

The Futures of Art in a Post-digital World

This post forms part of a much larger project around 'Post-digital Art Futures', further posts can be viewed below:

Exploring the Digital Art EcoSystem : How might the future role and value of Visual Art be transformed in a post-digital world?

Critical Tensions and Transformations Emerging within the Digital Art EcoSystem : Will a crypto-based art economy ever fulfil its promise of emancipation from the historical systems of access, power and value?

A Hypothesis of Change : Exploring potential forces of change shaping emergent futures within the art ecosystem

A New Social Operating System : What role might art play in our ability to imagine alternative positive human futures?

Possible Art Futures : Three Stories of (Post) Growth, power, Art, Ecology and Activism

You can view the extended versions of the three alternate futures narratives hereCivic Imagination : Transforming Governance for a Connected Future - speculative designs

Exploring the Domain + Key Lines of Enquiry

How might we might think more critically about the emerging economic models and systems of value & legitimacy that the Digital Art World invites; and their implications for the future role and value of all Art in the Post-Digital Age?

Defining Post-digital / For the purposes of clarity, I use the term’ post-digital’ to describe the period in which our intense historical fascination with all things digital has passed and we accept digital as being a core part of both society and the systems within it, rather than to describe some disenchantment or withdrawal from it.

How are systems of meaning and value being reshaped in the digital space?

How will the online merging of selling & critiquing shape our future ideas of the legitimacy of art?

How will the cultural context that is specific to the internet, change the way we think about collectable Art?

How are advancements in technology and digital platforms reshaping the role of the artist, enabling new forms of creative expression and expanding artistic boundaries?

If all art processes occur within a social and cultural context, how might the digital art space refocus the idea of art-making and production as a collective process?

How might this impact the systems operating within the art world?

In what ways might we see the systemic issues operating within the Arts economy, as representative of the broader economy in general?

There’s no question that NFTs will ever replace physical art completely, but they will disrupt the physical visual art industry and the systems within which it operates, in some way.It’s also interesting to consider the traditional Art Industry as an economic system representative of the broader economy; upon which the same power dynamics, economic structures and distribution models assign value, restrict access, cultivate inequity and amplify the widening gap between value creation and value extraction.

The Economics of Art

Those who completely dismiss digital art have much to lose and as long as artists perceive scarcity and physicality as the only route to true legitimacy and value, they will be forever beholden to these systemic structures of inequality.So when we explore visual art in the post-digital age; we are exploring the realm of the artist and the impact of digital technology but more importantly, we are exploring the shifting dynamics in both the domain (culture) and the field (society) at large — and how this challenges historical structures of wealth, power, value and legitimacy.

The Stakeholders

The digital art market has shifted the trajectory on both the supply + demand axis.

Despite fluctuating NFT sales, digital artist + collector engagement continues.

Whilst the market for NFTs (non-fungible tokens) surged to $2.5 billion in the first half of 2021, no doubt buoyed by Beeple’s USD$69million sale through Sotheby’s. However NFT sales have slowed significantly since 2021 with the majority of lower levels of NFT sales representing secondary sales over primary purchases (mints). Despite the fluctuating sales, new artists and collectors continue to join the major art platforms like Superrare, Foundation and ArtBlocks.

Digital + Physical | Trial + Error

Whilst declining patronage during Covid forced many museums and galleries online; the industry appears divided about how best to tackle the online space. Physical museums and galleries continue to experiment and adapt within the digital space — Sotheby’s NFT auction of Beeple’s ‘Everydays: First 5000 Days was sold for USD$69million and shook up the traditional art world. Likewise some galleries have joined forces online to exhibit whilst others have shifted to virtual-only exhibitions. Artcrush Gallery takes a different approach, exhibiting NFTs in the physical world via large scale digital billboards which feel more outdoor advertising than art gallery.

Museums have also experimented with the digitization of their works — The British Museum has partnered with LaCollection to release NFT collections; likewise the Whitworth Museum has also launched their own NFT artworks for sale. But there are also concerns some institutions are jumping the gun early without considering the longterm impacts of ‘NFT-ing’ their collections for sale — the Uffizi Gallery minted a single edition NFT of Michelangelo’s Doni Tondo (1505–’06) for $170,000 which industry observers say is concerning as Uffizi no longer has ownership over the NFT for the foreseeable future.

The Digital Protection Dilemma

Authenticity and provenance remain central issues to art collectors (and thus systems of value). NFTs stored on the blockchain have immutable provenance records, and companies like Truepic and Numbers Protocol have introduced decentralised provenance photo capture with no doubt more to come onto the market in the near future. Beyond blockchain authentication and record preservation which provides lineage to ownership; there are also the everyday issues of cryptosecurity and longterm provenance management that this new world of art-as-digital-asset surfaces.Moreover, cases like the scam purchase of a Banksy NFT and increasing cases of artists who discover their work has been ‘NFT’d’ without their permission or the $13.5million dollars worth of stolen BAYC NFTs . . all continue to fuel the uncertainty about this landscape will play out in future.

Systems of access, discovery + distribution are in flux

Incumbent models of distribution and access are problematic. Art galleries act as both tastemakers and gatekeepers, they are the consecrators of value who determine what will be shown and made visible. Museums also function to both preserve and historicize culture through their art collections. Both are problematic in that they operate within the dominant economic system with its internal bias and frameworks of value and legitimacy. Research shows that 85% of artists in U.S. museum collections are white, and 87% are male. There is concern amongst artists that the digital space is being colonised as another distribution and access network, without seeking to capitalise on the opportunity for increased artist discovery and access. Conversely, blockchains potentially represent their own form of exclusivity as collections are minted (and accessed) on one chain versus another.

Cryptoeconomics is catalysing the emergence of new organisational and economic structures

Cryptoeconomic systems are enabling more fluid non-linear, non-hierarchical organisations to form around community and project purposes (eg. DAOs) separate from the mainstream. New economic frameworks enable artists, collectors, curators and viewers to take advantage of (and shape) the shifting trajectories on both the supply and demand axis but how this plays out is still uncertain.

Digital scarcity remains an unresolved issue when it comes to value

Traditional models of art value rely on limited access and production to create value. NFT collections utilise these same structures with limited mints and rare collectibles and auction houses like Sotheby’s are attempting to transfer perceptions of scarcity as value to digital works. The mechanism of scarcity could easily be absorbed into old systems of power, value, distribution and access without realising the potential that the digital space offers for collective transformation of the art ecosystem.

Definitions + demarcations of value and purpose remain unresolved

There is little public understanding or distinction between Cryptoart and NFTs; Kyle Walters in his article Data in the Year of the NFT makes the distinction between Cryptoart (akin to fine art in digital format) versus NFT Art (referring to NFT mint collections. The challenge with these unresolved issues around definition and thus, demarcation of ‘art-as-asset’ classes, is that each functions differently in terms of purpose, function and within particular systems of value. Whilst ‘fine art style’ cryptoart is akin to fine art, NFT art functions as both utility and collectable asset. Further complicating the discourse is the genericization of the term ‘NFT’, which within digital parlance, refers to both art assets (more specifically) and utility tokens within web3 systems of community and governance.Furthermore, ongoing value debates continue about ‘what constitutes art’ with the contentious role of generative AI (in terms of perceived authorship and skill), and also concerns around the ownership of imagery utilised in large language model datasets from which the AI models work.

Interest in Digital Art remains steady

It’s too early to make a call on the commercial future of the digital art market. Whilst sales have declined since the 2021 NFT boom, within the context of global inflation and rising interest rates, many categories have also declined and we see this across ‘cars for sale’ and ‘bikes for sale’ search trends — so it’s too early to make a call on whether the digital art market has a commercial future and indeed industry analysts are forecasting 34.2% growth per year into the future.

Global Google Web Searches show that global online interest in ‘Digital Art’ + ‘Art for Sale’ remains steady with an overall increase in ‘Digital Art’ since 2020. ‘NFT Art’ increased during the 2021 boom and has declined since then. ‘Crypto Art’ also increased during the boom but also dropped off.

Global Google Images Searches suggest that ‘Digital Art’ has maintained momentum over the past 4 years; suggesting that whilst purchase intent (users looking for NFT and crypto art) has declined post-boom, interest in digital art still remains high.

According to the recently published Art Basel and UBS Global Art Market Report 2023 sales of collectible and art-related NFTs transacted through online platforms reached a remarkable $US13.3 billion in 2022.

Do we want to know whether the digital art market is economically viable + valuable? Or whether it plays an important role in the art space?

The other question these market forecasts surface is — how do we identify the ‘importance’ of the digital art market? By commercial dollars traded? What does that say about how we think about the role of art?

Trends

Australian Housing Affordability Index

Housing Affordability ↓ As housing affordability continues to decline in Australia and around the world, we may see interest in non-physical art amongst younger collectors rise.

KVB Market Research Report

Creative Software Market ↑ The creative software market driven by business, continues to rise, adding to the already exploding landscape of creative digital tools and platforms.

The Role of Art within Cultural EcoSystems

The Future Art EcoSystems Report identify two defining system structures for the future of digital art:

The idea of the tech industry operating as art patron

The development of vertically integrated ‘art stacks’ which cut out the conventional constraints of the historical system.

The latest thinking from Carnegie Mellon points to an emerging role of Art within Smart Cities as a form of connection and communication; both as an imaginative process of engagement and reinforcing a sense of identity and place amongst residents.A recent report developed by Changeist in collaboration with Arup, ArtScience Museum Singapore and Audience Labs notes ecosystems, business models and funding as key areas for future focus, along with the social value of art and equity / inclusivity. It also presents ‘digital stages’ of new creators, audiences and tools as reshaping the future landscape.

///

The Futures of Art in a Post-digital World

This post forms part of a much larger project around 'Post-digital Art Futures', further posts can be viewed below:

Exploring the Digital Art EcoSystem : How might the future role and value of Visual Art be transformed in a post-digital world?

Critical Tensions and Transformations Emerging within the Digital Art EcoSystem : Will a crypto-based art economy ever fulfil its promise of emancipation from the historical systems of access, power and value?

A Hypothesis of Change : Exploring potential forces of change shaping emergent futures within the art ecosystem

A New Social Operating System : What role might art play in our ability to imagine alternative positive human futures?

Possible Art Futures : Three Stories of (Post) Growth, power, Art, Ecology and Activism

You can view the extended versions of the three alternate futures narratives hereCivic Imagination : Transforming Governance for a Connected Future - speculative designs

Exploring the Domain + Key Lines of Enquiry

How might we might think more critically about the emerging economic models and systems of value & legitimacy that the Digital Art World invites; and their implications for the future role and value of all Art in the Post-Digital Age?

Defining Post-digital / For the purposes of clarity, I use the term’ post-digital’ to describe the period in which our intense historical fascination with all things digital has passed and we accept digital as being a core part of both society and the systems within it, rather than to describe some disenchantment or withdrawal from it.

How are systems of meaning and value being reshaped in the digital space?

How will the online merging of selling & critiquing shape our future ideas of the legitimacy of art?

How will the cultural context that is specific to the internet, change the way we think about collectable Art?

How are advancements in technology and digital platforms reshaping the role of the artist, enabling new forms of creative expression and expanding artistic boundaries?

If all art processes occur within a social and cultural context, how might the digital art space refocus the idea of art-making and production as a collective process?

How might this impact the systems operating within the art world?

In what ways might we see the systemic issues operating within the Arts economy, as representative of the broader economy in general?

There’s no question that NFTs will ever replace physical art completely, but they will disrupt the physical visual art industry and the systems within which it operates, in some way.It’s also interesting to consider the traditional Art Industry as an economic system representative of the broader economy; upon which the same power dynamics, economic structures and distribution models assign value, restrict access, cultivate inequity and amplify the widening gap between value creation and value extraction.

The Economics of Art

Those who completely dismiss digital art have much to lose and as long as artists perceive scarcity and physicality as the only route to true legitimacy and value, they will be forever beholden to these systemic structures of inequality.So when we explore visual art in the post-digital age; we are exploring the realm of the artist and the impact of digital technology but more importantly, we are exploring the shifting dynamics in both the domain (culture) and the field (society) at large — and how this challenges historical structures of wealth, power, value and legitimacy.

The Stakeholders

The digital art market has shifted the trajectory on both the supply + demand axis.

Despite fluctuating NFT sales, digital artist + collector engagement continues.

Whilst the market for NFTs (non-fungible tokens) surged to $2.5 billion in the first half of 2021, no doubt buoyed by Beeple’s USD$69million sale through Sotheby’s. However NFT sales have slowed significantly since 2021 with the majority of lower levels of NFT sales representing secondary sales over primary purchases (mints). Despite the fluctuating sales, new artists and collectors continue to join the major art platforms like Superrare, Foundation and ArtBlocks.

Digital + Physical | Trial + Error

Whilst declining patronage during Covid forced many museums and galleries online; the industry appears divided about how best to tackle the online space. Physical museums and galleries continue to experiment and adapt within the digital space — Sotheby’s NFT auction of Beeple’s ‘Everydays: First 5000 Days was sold for USD$69million and shook up the traditional art world. Likewise some galleries have joined forces online to exhibit whilst others have shifted to virtual-only exhibitions. Artcrush Gallery takes a different approach, exhibiting NFTs in the physical world via large scale digital billboards which feel more outdoor advertising than art gallery.

Museums have also experimented with the digitization of their works — The British Museum has partnered with LaCollection to release NFT collections; likewise the Whitworth Museum has also launched their own NFT artworks for sale. But there are also concerns some institutions are jumping the gun early without considering the longterm impacts of ‘NFT-ing’ their collections for sale — the Uffizi Gallery minted a single edition NFT of Michelangelo’s Doni Tondo (1505–’06) for $170,000 which industry observers say is concerning as Uffizi no longer has ownership over the NFT for the foreseeable future.

The Digital Protection Dilemma

Authenticity and provenance remain central issues to art collectors (and thus systems of value). NFTs stored on the blockchain have immutable provenance records, and companies like Truepic and Numbers Protocol have introduced decentralised provenance photo capture with no doubt more to come onto the market in the near future. Beyond blockchain authentication and record preservation which provides lineage to ownership; there are also the everyday issues of cryptosecurity and longterm provenance management that this new world of art-as-digital-asset surfaces.Moreover, cases like the scam purchase of a Banksy NFT and increasing cases of artists who discover their work has been ‘NFT’d’ without their permission or the $13.5million dollars worth of stolen BAYC NFTs . . all continue to fuel the uncertainty about this landscape will play out in future.

Systems of access, discovery + distribution are in flux

Incumbent models of distribution and access are problematic. Art galleries act as both tastemakers and gatekeepers, they are the consecrators of value who determine what will be shown and made visible. Museums also function to both preserve and historicize culture through their art collections. Both are problematic in that they operate within the dominant economic system with its internal bias and frameworks of value and legitimacy. Research shows that 85% of artists in U.S. museum collections are white, and 87% are male. There is concern amongst artists that the digital space is being colonised as another distribution and access network, without seeking to capitalise on the opportunity for increased artist discovery and access. Conversely, blockchains potentially represent their own form of exclusivity as collections are minted (and accessed) on one chain versus another.

Cryptoeconomics is catalysing the emergence of new organisational and economic structures

Cryptoeconomic systems are enabling more fluid non-linear, non-hierarchical organisations to form around community and project purposes (eg. DAOs) separate from the mainstream. New economic frameworks enable artists, collectors, curators and viewers to take advantage of (and shape) the shifting trajectories on both the supply and demand axis but how this plays out is still uncertain.

Digital scarcity remains an unresolved issue when it comes to value

Traditional models of art value rely on limited access and production to create value. NFT collections utilise these same structures with limited mints and rare collectibles and auction houses like Sotheby’s are attempting to transfer perceptions of scarcity as value to digital works. The mechanism of scarcity could easily be absorbed into old systems of power, value, distribution and access without realising the potential that the digital space offers for collective transformation of the art ecosystem.

Definitions + demarcations of value and purpose remain unresolved

There is little public understanding or distinction between Cryptoart and NFTs; Kyle Walters in his article Data in the Year of the NFT makes the distinction between Cryptoart (akin to fine art in digital format) versus NFT Art (referring to NFT mint collections. The challenge with these unresolved issues around definition and thus, demarcation of ‘art-as-asset’ classes, is that each functions differently in terms of purpose, function and within particular systems of value. Whilst ‘fine art style’ cryptoart is akin to fine art, NFT art functions as both utility and collectable asset. Further complicating the discourse is the genericization of the term ‘NFT’, which within digital parlance, refers to both art assets (more specifically) and utility tokens within web3 systems of community and governance.Furthermore, ongoing value debates continue about ‘what constitutes art’ with the contentious role of generative AI (in terms of perceived authorship and skill), and also concerns around the ownership of imagery utilised in large language model datasets from which the AI models work.

Interest in Digital Art remains steady

It’s too early to make a call on the commercial future of the digital art market. Whilst sales have declined since the 2021 NFT boom, within the context of global inflation and rising interest rates, many categories have also declined and we see this across ‘cars for sale’ and ‘bikes for sale’ search trends — so it’s too early to make a call on whether the digital art market has a commercial future and indeed industry analysts are forecasting 34.2% growth per year into the future.

Global Google Web Searches show that global online interest in ‘Digital Art’ + ‘Art for Sale’ remains steady with an overall increase in ‘Digital Art’ since 2020. ‘NFT Art’ increased during the 2021 boom and has declined since then. ‘Crypto Art’ also increased during the boom but also dropped off.

Global Google Images Searches suggest that ‘Digital Art’ has maintained momentum over the past 4 years; suggesting that whilst purchase intent (users looking for NFT and crypto art) has declined post-boom, interest in digital art still remains high.

According to the recently published Art Basel and UBS Global Art Market Report 2023 sales of collectible and art-related NFTs transacted through online platforms reached a remarkable $US13.3 billion in 2022.

Do we want to know whether the digital art market is economically viable + valuable? Or whether it plays an important role in the art space?

The other question these market forecasts surface is — how do we identify the ‘importance’ of the digital art market? By commercial dollars traded? What does that say about how we think about the role of art?

Trends

Australian Housing Affordability Index

Housing Affordability ↓ As housing affordability continues to decline in Australia and around the world, we may see interest in non-physical art amongst younger collectors rise.

KVB Market Research Report

Creative Software Market ↑ The creative software market driven by business, continues to rise, adding to the already exploding landscape of creative digital tools and platforms.

The Role of Art within Cultural EcoSystems

The Future Art EcoSystems Report identify two defining system structures for the future of digital art:

The idea of the tech industry operating as art patron

The development of vertically integrated ‘art stacks’ which cut out the conventional constraints of the historical system.

The latest thinking from Carnegie Mellon points to an emerging role of Art within Smart Cities as a form of connection and communication; both as an imaginative process of engagement and reinforcing a sense of identity and place amongst residents.A recent report developed by Changeist in collaboration with Arup, ArtScience Museum Singapore and Audience Labs notes ecosystems, business models and funding as key areas for future focus, along with the social value of art and equity / inclusivity. It also presents ‘digital stages’ of new creators, audiences and tools as reshaping the future landscape.

///

The Futures of Art in a Post-digital World

This post forms part of a much larger project around 'Post-digital Art Futures', further posts can be viewed below:

Exploring the Digital Art EcoSystem : How might the future role and value of Visual Art be transformed in a post-digital world?

Critical Tensions and Transformations Emerging within the Digital Art EcoSystem : Will a crypto-based art economy ever fulfil its promise of emancipation from the historical systems of access, power and value?

A Hypothesis of Change : Exploring potential forces of change shaping emergent futures within the art ecosystem

A New Social Operating System : What role might art play in our ability to imagine alternative positive human futures?

Possible Art Futures : Three Stories of (Post) Growth, power, Art, Ecology and Activism

You can view the extended versions of the three alternate futures narratives hereCivic Imagination : Transforming Governance for a Connected Future - speculative designs

Tags

future digital art, civic imagination,

⚒️ | Figma | Pitch | Midjourney

You might also like

Political Notion

Information Architecture

Political Notion

Information Architecture

Neurodiversity Resources

Concept Development

Neurodiversity Resources

Concept Development

🛠️ Tools + Resources